Lou’s Views

News & Views / November Edition

Calendar of Events –

Discover a wide range of things to do in the Brunswick Islands for an experience that goes beyond the beach.

Discover a wide range of things to do in the Brunswick Islands for an experience that goes beyond the beach.

For more information » click here.

Calendar of Events Island –

Turkey Trot

The Town of Holden Beach will hold its ninth annual Turkey Trot on Thanksgiving morning, November 23rd at 8:00 am All individuals interested in participating should call 910.842.6488 to register. Please bring a canned food item to donate to the local food pantry.

Gingerbread Creation Contest

The Town of Holden Beach will sponsor a gingerbread creation competition to be judged as part of our annual tree lighting event on November 30th. There will be two categories, one for businesses and one for individuals. Note that age will not be a determining factor in judging. The majority of the creation’s components must be edible. Judging will be by popular vote of those attending the tree lighting event. All interested parties should register by November 21st by emailing Christy at [email protected]. Creations should be dropped off at the Holden Beach Pavilion between 4:15 p.m. and 4:30 p.m. on November 30th. Participants who wish to have their creations displayed after the event concludes will need to be prepared to move them to Town Hall following the conclusion of the tree lighting event. The staff will not be able to take responsibility for moving them.

Tree Lighting

Come one, Come all!

The Town of Holden Beach will hold its fifteenth annual Tree Lighting annual tree lighting ceremony on Thursday, November 30th at 6 pm, entertainment starts at 5:15 pm.

Pickleball Classes

Pickleball Classes

Pickleball classes will be held every Monday starting at 10:00 a.m. for beginners/11:00 a.m. for intermediate and every Tuesday starting at 5:30 p.m. for beginners and 6:30 p.m. for intermediate beginning December 4th at Bridgeview Park. Cost is $100 for the season for both residents and non-residents or $180 for two classes per week for the season.

For more information » click here

Sandy Paws Dog Parade

Join us on Saturday, December 9th at 10:00 am outside the Town Hall Public Assembly for our annual Sandy Paws Dog Parade. This will be a short walk to the Pavilion where you can have you dog’s picture taken with Santa.

The Chapel Choir Christmas Musical Performance

The Holden Beach Choir is preparing for its second Christmas concert with a live orchestra. On Sunday December 17th at 7:00 pm, the choir will present the musical The Wonders of His Love, accompanied by a Chamber Orchestra.

Parks & Recreation / Programs & Events

For more information » click here

Reminders –

Solid Waste Pick-Up Schedule

GFL Environmental change in service, trash pickup will be once a week. This year September 30th was the the last Saturday trash pick-up until June. Trash collection will go back to Tuesdays only.

Please note:

. • Trash carts must be at the street by 6:00 a.m. on the pickup day

. • BAG the trash before putting it in the cart

. • Carts will be rolled back to the front of the house

Solid Waste Pick-up Schedule – starting October once a week

Recycling – starting October every other week

Yard Waste Service

Yard Waste Service

Yard debris is collected on the second (2nd) and fourth (4th) Fridays during the months of October, November, and December. Yard debris needs to be secured in a biodegradable bag (not plastic) or bundled in a maximum length not to exceed five (5) feet and fifty (50) pounds in weight. Each residence is allowed a total of ten (10) items, which can include a combination of bundles of brush and limbs meeting the required length and weight and/ or biodegradable bags. Picks-ups are not provided for vacant lots or construction sites.

Upon Further Review –

Bike Lane

Bike Lane

Property owners along Ocean Boulevard were sent a CAMA notice from the DOT

.

Key takeaways:

- Add 7’ asphalt to the south side of existing pavement

- Add 3’ asphalt to the north side of existing pavement

- Recenter the travel lanes

- Create two (2) five (5) foot bike lanes on either side of the road

DOT informed us the cost of the has significantly increased by almost 30%

The good news is that our portion is only an additional $23,000 so far

Previously reported – October 2023

DOT Bike Lane Report Presentation » click here

The plan includes bike lanes of 5’ on each side of Ocean Boulevard. It will be an asymmetrical widening, that is 7’ on the south side and only 3’ on the north side where the sidewalk is.

Highland Paving has been awarded the contract and has already met with the town staff

Surveying has already been completed and work on storm water issues will begin in November

Paving prep work will start once that is completed, probably sometime in December

They anticipate that the actual paving project will be done beginning March

Work will be done starting from the west end of the island working east

They are still committing to completing the project before Memorial Day

THB Newsletter (10/20/23)

Ocean Boulevard Resurfacing and Bike Lane Project

Highland Paving met with the Department of Transportation and staff last week to discuss the upcoming project. They communicated that storm water work will begin in November. The subsequent paving prep work, which we are thinking will take place in December, will involve removal of the road shoulders, three feet on the north side of the road and seven feet on the south side of the road. We do not know where the contractor will be at any given point in time. Property owners are responsible for removing any material (landscape timbers/specialty rock, etc.) from the construction area that they don’t want hauled off by the contractor. Replacement material will be generic ABC stone. Mailboxes will be moved/reset, but if they fall apart, the contractor will install a generic replacement. We are forecasting the paving won’t begin until March/April, with the project being completed by Memorial Day.

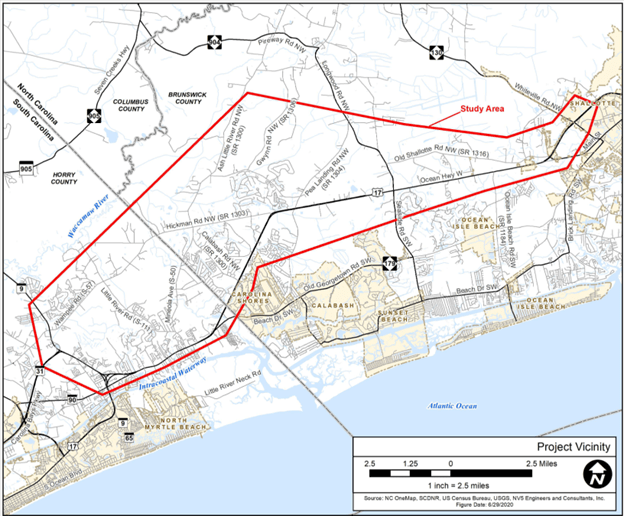

Carolina Bays Parkway project S.C. 31

Carolina Bays Parkway project S.C. 31

As many of you know the extension of Carolina Bays 31 from SC to NC has been an ongoing project for many years that has been accelerated by the fact that SC has the funding and the desire to complete the existing SC31 to the NC state line. This has caused NC to come up with plan even though they have no funding for the road to enter NC and go north towards Wilmington.

There have been numerous rumors about what routes are and are not being considering and quite honestly there are some things that we do know for fact after the most recent meeting but there are even more things that we, and NCDOT for that matter, don’t have answers to at this point. The purpose of this communication is to make everyone aware of what we know. At the Sept Board meeting the Community Impact Committee made a presentation that clearly identified 2 of the proposed routes along with many of the details surrounding a project like this. It is suggested that if you haven’t seen it to review the below “Enumerate Engage – Login” link for more detail about this project.

- What we know based on the last meeting with the NCDOT two weeks ago;

- SC has the funding thru a sales tax in Horry County

- SC has asked NC where to end their construction to the NC SC state line or in other words, where does NC want the SC portion to end?

- NC has selected route 4 which is east of Indigo Farms near Hickman Road (NC 57)

- Carolina Bays is a high priority for the BC county region of NCDOT but there is NO funding for this project, and it will have to compete with other projects throughout NC based on a set of criteria which at this point has placed it as a low priority within NC.

- NCDOT has decided to have a 3 Phase plan for the road in NC.

- What we know based on the last meeting with the NCDOT two weeks ago;

* Phase 1 will take SC31 from the state line to a new interchange at Ash Little River Road

* Phase 2 will take it from there to Longwood Road NW (Rte. 904) near the Grissettown Longwood Fire and Rescue Department.

* Phase 3 will take it from there to Route 17 at either the Rte. 904 or the Rte. 130 intersection

- The Environmental Impact Study (EIS) although not officially approved is close to approval and once it is approved there will be 2 public meetings (one in NC & one in SC) to solicit input on the 2 alternative routes to connect to 17. These meetings will take place sometime in mid to late Q1 ’24

- At this point only Phase 1 & 2 are locked in with preliminary funding expected in 2025 or 2026

- Phase 3 is still under review. No route has been selected albeit there is solid rationale for both alternatives and a route must be selected prior to any State or Federal funding proposals that are to be are submitted.

- The public meetings will be VERY important in determining the Phase 3 route !!!

ORMA

Without funding, NCDOT continues Carolina Bays Parkway discussion

On Oct. 16, the Grand Strand Area Transportation Study (GSATS) Transportation Advisory Committee (TAC) and the GSATS Policy Committee with both North Carolina and South Carolina participants met. Both meetings were held at Ocean Isle Beach Town Hall. Both meetings were open to the public and focused on the Carolina Bays Parkway Extension project that will extend Carolina Bays Parkway — also known as South Carolina Highway 31 — from South Carolina Highway 9 in Horry County, South Carolina, across the North Carolina state line to US Highway 17 in Brunswick County. Representatives from participating towns, cities and counties and project leads from the North Carolina Department of Transportation (NCDOT) were in attendance. During the combined policy meeting, participants received a presentation by NCDOT Division 3 Engineer Chad Kimes and Project Development and Environment Analysis (PDEA) Engineer Mason Herndon. Kimes told the committee that NCDOT wants to start obtaining funding for the extension by the end of next year to get the North Carolina side of the project moving. “I can tell you, Carolina Bays is one of our number one priorities in this region that’s unfunded, currently, by the state of North Carolina,” he said. Kimes explained that they are going to try several ways to get state funding over the next few months and they will know a little more by spring 2024. He noted that the project had been submitted for state funding in the past, however, they have yet to receive any money. “The lowest project to score in our scoring system that got picked up in our [Transportation Improvement Plan (TIP)] program scored a 74.6,” he said. “We were scoring the Carolina Bays at a 62.71. The difference between that 62 and that 74.6 is about $14 billion worth of projects in between, so there was a big difference…” He told the board that NCODT will be applying for federal grants too, however, all grants will require a match by the state. “On a price tag like this, North Carolina can match anywhere between 30 and 50% on federal grants but we will be pursuing it,” Kimes said. If they do apply for federal grants, the project may score better in the prioritization process because it will bring down the overall cost of the project for North Carolina. Kimes noted they are looking to lower project costs by eliminating interchanges and installing superstreets, adding they may reduce the number of right a ways, too, and that things can be changed in the future. Kimes said they are seeking to connect the project to US Highway 17 sooner to lower overall costs and are still considering installing tolls along the project to offset the total cost as well. Herndon gave the Policy Committee, along with a good-sized audience, a presentation on NCDOT’s progress on the project, funding and planning. Herndon said they are studying seven different routes in the draft Environmental Impact Statement (EIS), however, alternative route four is the preferred one at the moment. He explained that one of the interchanges would go up to Ash Little River Road in Ash. Alternative four would connect with South Carolina at Hickman Road Northwest in Calabash, and travel through Hickmans Crossroads. It would cross the Hickmans Branch River and the Cawcaw Swamp. The suggested route would take the project to Gwynn Road Northwest in Longwood and Bland Road Northwest in Longwood. If alternative map four is chosen for the extension, the project would not connect with US Highway 17 until its intersection with Longwood Road and Seaside Road near Grissettown. “Alternative four ties into [US Highway] 17 at the 904 intersection,” Herndon said. Asked how much money had been committed on North Carolina’s end, Herndon said none. He said they were told by the Federal Highway Administration (FHA) to look at an “affordable solution” to get the project started since they have no funding currently. He said NCDOT has been working on it and has sent the draft EIS, which includes all seven alternatives, to the FHA. He said NCDOT will eventually have a financial plan to show their commitment to the entire project with South Carolina. Herndon said the project would be done in phases — phase one would either stop at the North Carolina and South Carolina boarder or carry into Brunswick County up to Ash Little River Road. “Now, we’re not talking about this as the complete project, this is just phase one of the project,” he said. “Every project that we’ve got is so many miles long that we build it in sections, and it has to have logical termini. So, basically, those are the two logical termini we feel like we can start with.” If phase one was carried into Brunswick County, he said an interchange would be built at Ash Little River Road. “This would require us to do improvements along Hickman Road and along Ash Little River Road to get traffic to 904 until phase two is built,” he said. A timeline for phase one could not be provided at this time. “Until we actually have money in the bank for this project in North Carolina… that’s going to be when we can really develop a timeline,” Herndon said. He said they hope that having this plan, with some committed funds, will help move things forward, and also explained that the final EIS may not get approved without a full financial plan for the entire project. Kimes said he felt confident that they will receive right of way funding by the end of 2024 to kickstart the project. With the project plan coming together, Herndon said he expects public hearings to commence in early 2024. Shallotte Mayor Walt Eccard said he has been telling folks for three years that there would be a meeting to discuss the draft EIS. He asked how sure they were about the public hearings and if early 2024 was a reasonable date to tell people. In response, Herndon said he felt fairly confident that there would be public meetings for the extension, and they could begin in early 2024. He noted that the final EIS meeting might not be until the end of 2024 or beginning of 2025. “The public hearings after the draft EIS [are] to give public input on what we’re proposing,” Herndon said. He explained the final EIS would contain the final determined route for the Carolina Bay Parkway Extension, however, the drafted EIS, used for information purposes, will include all seven alternative routes. Brunswick County Board of Commissioners Chair Randy Thompson said there would be major construction work that would take years if alternative four is chosen. He said he was concerned about the potential traffic on affected roads during the duration of the project’s construction, noting that traffic is already a major issue with the county’s increasing population growth. “We need the highway, there’s no doubt about that. We need the highway,” Thompson said. Kimes said they will look at all the potentially effected roads to see what they can handle and make sure steps are in place for potentially needed improvements. All of the alternative routes can be found online on the NCDOT website at https://www.ncdot.gov/projects/carolina-bays-parkway/Pages/project-maps.aspx

Brunswick Beacon

Previously reported – August 2023

Here’s why a major road project connecting Myrtle Beach and Brunswick remains stalled

A combined effort by the North and South Carolina departments of transportation looks to connect two major highways near the states’ borders, but the project has been slow moving for a number of years. The Carolina Bays Parkway project looks to extend S.C. 31 from S.C. 9 in Horry County across the state line to U.S. 17 in southwestern Brunswick County. The project was first conceived nearly two decades ago in the early 2000s as a way to ease congestion in South Carolina’s Grand Strand communities and create an alternative route parallel to U.S. 17. The preliminary study area encompassed land largely in Brunswick County along U.S. 17, including Carolina Shores, Calabash and a portion of Shallotte. The project study area is roughly 19 miles long, including some 14 miles located in North Carolina and approximately five miles in South Carolina. Currently, motorists traveling between the two states by way of Brunswick County largely take an inefficient route down U.S. 17 through the Little River area before connecting to S.C. 31. Another route from Brunswick County to Horry County is two-lane – and largely residential – Hickman Road. With several planned developments approved to be built in the area over the next few years, an NCDOT study estimated many of the roads and intersections in the study area would approach, reach or exceed capacity limits within the decade. “The population within Horry and Brunswick counties has steadily increased, and is expected to continue to increase, along with the number of tourists to the area,” the project outlines. “Growth in population, tourism, and supporting services has resulted in an increase in mixed-purpose traffic on area roads.” This extension looks to improve traffic flow between the states.

Funding the project

According to the NCDOT, the project is estimated to total $552 million between the two states, with North Carolina’s portion estimated at $367 million and South Carolina’s at $185 million. At a recent meeting of the Wilmington Urban Area Metropolitan Planning Organization, NCDOT Division 3 Division Engineer Chad Kimes said South Carolina intends to extend S.C. 31, bringing six lanes of highway into North Carolina. Kimes said the NCDOT is still working on its connection. Kimes added that South Carolina’s portion of the project is fully funded while North Carolina’s portion has yet to be funded.

Timeline

The NCDOT is still working to determine a start date for the project, while SCDOT is expected to begin right of way acquisition next year. According to the NCDOT, an environmental impact document is expected to be submitted later this year, with a public hearing regarding the project anticipated for early 2024. Dates for when right of way acquisition in North Carolina and construction could begin have yet to be determined. According to the NCDOT, there are currently no upcoming public meetings scheduled regarding the project, but the public is asked to submit feedback on the department’s website.

Read more » click here

Previously reported – January 2023

Carolina Bays Parkway

A massive highway project looking to connect Brunswick County and Myrtle Beach could see major movement in 2023. The Carolina Bays Parkway project was first conceived in the early 2000s. Long awaited and highly anticipated, the project hopes to connect S.C. 31 and U.S. 17 in Brunswick County. With the need for a new route in southern Brunswick greater than ever with commercial and residential developments booming across the county, the project is now nearing some concrete milestones. Seven possible routes are undergoing more detailed studies to find the corridor with the least human and environmental impacts. N.C. Department of Transportation officials anticipate results from those studies will be shared with the public in February 2023 with a public comment period to follow. The project is expected to cost the two states $552 million and is only partially funded at this point.

Corrections & Amplifications –

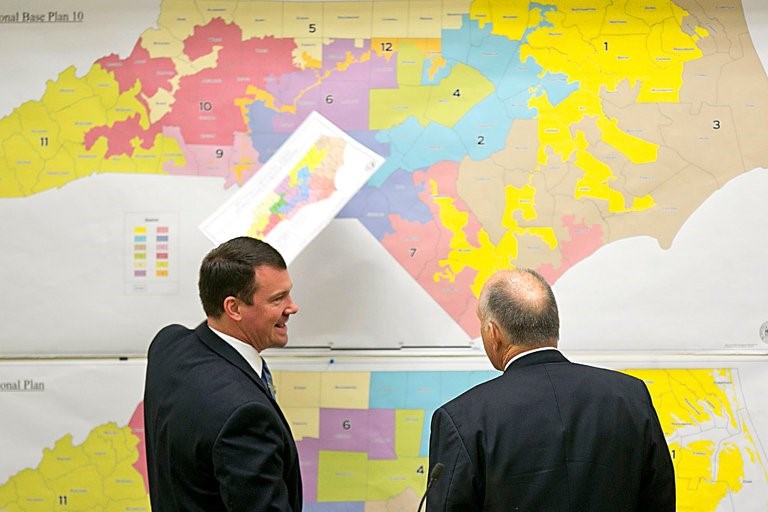

N.C. Republicans pass redistricting map expected to flip 3 House seats

In a move that could solidify GOP power in the state for years to come, North Carolina Republicans passed new congressional and state legislative maps Wednesday that could flip three or four U.S. House seats while easing a path for the party to hold onto veto-proof majorities over state legislation. Critics of the map say it weakens democracy by limiting the power of Black and Brown voters and crafting districts into GOP strongholds that curb Democratic voters’ influence. “North Carolina is now one the most egregiously gerrymandered states in the country,” said Eric Holder, the former U.S. attorney general and current head of the National Democratic Redistricting Committee. Proponents say they are allowed to draw maps that favor political parties because of recent court precedent, and that Republicans have the power to do so because they won more seats in both chambers. “The chickens are coming home to roost for the Democrats,” said Paul Shumaker, a senior Republican consultant in North Carolina. “Elections have consequences.” The Republican redistricting of North Carolina is the party’s latest attempt to redefine congressional voting districts nationwide as cases across the South, including in Alabama and South Carolina, face legal challenges. The newly enacted districts come almost a year after the state Supreme Court flipped from Democratic to Republican control in the 2022 elections, and GOP justices ruled in April that redistricting for partisan gain was constitutional under state law. That decision reversed a ruling a year earlier from the state’s highest court that threw out proposed boundaries because of what it saw as illegal partisan gerrymandering. The map creates 10 likely Republican districts, three likely Democratic districts and one that appears to be competitive, according to statewide election data. North Carolina’s 14 congressional seats are evenly split between Democrats and Republicans after a temporary map was created following the top court’s decision to throw out a Republican-proposed map. The new map would probably flip at least three of those seats to the GOP, which could also help give them control in a U.S. House where Republicans hold a narrow 221-212 majority. The three- or four-seat swing is significant even for partisan gerrymanders, experts say, showing how court elections can significantly alter the direction of a state and, potentially, control of the U.S. House. In an analysis of recent elections in North Carolina, Duke University mathematics professor Jonathan Mattingly, who studies the effects of gerrymandering, found that electoral outcomes under the Republican maps wouldn’t reflect voters’ changing preferences, even when Democrats overperform. “If the opinion of the people changes sufficiently, who is elected should change,” Mattingly said. “These maps are nonresponsive. With them, the elections have no consequences. That’s not really democracy.” Andrew Taylor, a N.C. State University political science professor and the director of the Free and Open Societies Project, said the North Carolina legislature has some of the most leeway of any in the country to enact new voting districts, though it is subject to existing federal law. Taylor, who has previously served as an expert witness for Republicans, said he expects legal challenges to follow the bill’s passage. Experts across North Carolina agree that legal challenges will be forthcoming, alleging that the redistricted maps are racially gerrymandered and unlawful under the Voting Rights Act because they don’t allow Black voters to fairly elect their representatives. Morgan Jackson, a Democratic strategist in the state, said he think there’s likely a viable path to challenge the new map on the grounds that it dilutes the Black vote after the U.S. Supreme Court ruled Alabama’s new congressional map was unconstitutional for that reason. That’s in addition to the aggressive gerrymander he says will limit Democratic voters’ influence statewide. “They’ve taken essentially a 50-50 state and drawn a map where 80 percent of voters will have a Republican member of Congress,” said Jackson, the Democratic Party strategist. Some advocates and organizations in North Carolina have started analyzing the maps for possible pathways to file lawsuits. That includes Hilary Klein from the Southern Coalition for Social Justice, who wrote in a letter to state GOP leaders that the state Senate legislative districts effectively dilute the Black vote in at least two seats. “It is clear as day,” Klein said. “Anybody who knows anything about North Carolina knows the Senate map is going to deprive North Carolina’s Black Belt of any representation.” Mattingly’s analysis also found that the maps probably will help Republicans hold onto majorities — and potentially veto-proof majorities — in both chambers. The redistricting is also likely to help Republicans’ attempts to keep the seat of Rep. Tricia Cotham, who switched from the Democratic Party to the Republican Party in April, giving the GOP a razor-thin supermajority. Republicans have defended their maps, arguing that they reversed Democratic judicial overreach, and that Democrats would similarly redraw maps to favor their side. They also argued that drawing maps favoring a political party is legal, according to the state’s highest court. During debate on the maps, they instead argued that Democrats must try to appeal to rural voters. “We have complied with the law in every way on these maps,” Republican state Rep. Destin Hall said. “Our overarching goal in the creation of this House plan was to create Republican-leaning districts where possible.” In the U.S. House, the plan could squeeze out Democratic Reps. Jeff Jackson, Wiley Nickel and Kathy E. Manning, while freshman Rep. Donald G. Davis would run in the one competitive district. Davis is one of three Black Democrats from the state in the House. “Once again, this General Assembly has enacted maps that racially gerrymander North Carolinians in an effort to ensure a predetermined outcome: large majorities for Republicans in both chambers and an outsize share of the Congressional delegation in a purple state,” said state House Minority Leader Robert Reives in a statement. Gov. Roy Cooper (D) has also come out against the proposals, though the redistricting is not subject to his veto. “They have used race and political party to create districts that are historically discriminatory and unfair,” Cooper said in a statement. North Carolina is just over a fifth Black, according to U.S. Census data. Republican lawmakers said they did not use racial demographic data to create the districts. How the Republican lawmakers created the maps, though, is unclear. Because of a recently passed budget resolution, communications about the redistricting process among state lawmakers are not subject to freedom of information requests, making it more difficult for the public to know what was considered with the maps. Legislators can destroy their communications concerning the map’s design when they see fit. Top Republican lawmakers and aides involved in the process did not immediately respond to a request for comment Wednesday. In 2022, when the state Supreme Court threw out Republicans’ proposed map, those communications proved relevant in the legal challenges to showing that, according to the court, the new borders were illegal partisan gerrymanders. U.S. Rep. Deborah K. Ross (D-N.C.) said Republicans made the change so they could legislate in a “much more secretive way.” “This is not only a power grab, but it’s a power grab under the cover of darkness,” Ross told The Washington Post. The change is one of many the Republicans have instituted since taking a veto-proof majority. The legislature has also faced lawsuits over voting laws and election boards.

Read more » click here

Odds & Ends –

How this Brunswick beach town is cracking down on short-term rental properties

Officials in one Brunswick County beach town are looking to keep a closer eye on short-term rental properties. After discovering many short-term rentals in Sunset Beach were underreporting or not reporting proper accommodations tax to the town, town officials have signed a $45,000 yearlong contract with GovOS to help better monitor such properties in the town. GovOS is a software platform that works with state and local governments to streamline various processes involving property, licensing and taxing. GovOS promised its short-term rental software would help increase short-term compliance in the town. According to Sunset Beach staff, research on this subject in the town began over two years ago. GovOS estimated the town has 637 short-term rental properties. Of those, the company estimated some 200 are fully in compliance with the town’s accommodation tax ordinance. Accommodations tax is a tax on short-term rental properties – properties that are rented through platforms such as AirBnB or VRBO. In Sunset Beach, accommodations taxes are levied at a rate of 6% of the gross rental income, which includes a 3% tourism-related expenditure tax, a 2% beach nourishment and protection tax, and a 1% county tourism and travel tax. According to Sunset Beach, the property owner or agent are required to pay the full 6% tax to the town with a tax report form monthly based on income from the previous month. Even if no rental receipts are applicable for that month, property owners or agents must file reports month. The software will allow the town to identify properties currently being used for short-term rentals – a feat town staff has struggled with in the wake of the explosion of short-term rental platforms such as AirBnB and VRBO. Once the properties are identified, the software will report the short-term rental properties to the town along with a variety of information on the properties and their tax reporting history. The more properties that properly comply, the more accommodations tax revenue the town will receive. According to the town’s budget for the 2023-24 fiscal year, the town anticipates collecting some $775,000 in accommodations taxes, a figure that could be nearly doubled if this software is successful. The Sunset Beach Town Council heard a presentation from GovOS in September before awarding the contract in October, at the request of town staff.

Read more » click here

From Colin Campbell at WUNC comes this report about North Carolina’s legislature exempting itself from the public transparency law that will still apply to the governor, mayors across the state, and agency leaders. (Thanks to reader Minta P for flagging this.) “North Carolina law allows the public to obtain a variety of documents from state government and its elected officials. Anyone can get copies of emails sent to an elected official or access their calendar to see when they met with lobbyists,” Campbell wrote. But now “the lawmakers themselves can decide what to make public — and which documents to delete or toss in the shredder.”

From Colin Campbell at WUNC comes this report about North Carolina’s legislature exempting itself from the public transparency law that will still apply to the governor, mayors across the state, and agency leaders. (Thanks to reader Minta P for flagging this.) “North Carolina law allows the public to obtain a variety of documents from state government and its elected officials. Anyone can get copies of emails sent to an elected official or access their calendar to see when they met with lobbyists,” Campbell wrote. But now “the lawmakers themselves can decide what to make public — and which documents to delete or toss in the shredder.”

Freedom of information laws — both federal and at the state level — are a powerful tool for unearthing bad behavior. This is a retreat from the public’s right to know.

NC lawmakers exempt themselves from public records laws while Democrats blast ‘secret police’ powers

North Carolina’s legislature is now exempt from the public records law that governs other branches of government. The change is a last-minute addition to the state budget, and it comes alongside a major expansion of the legislature’s ability to seize documents from state agencies and private contractors. North Carolina law allows the public to obtain a variety of documents from state government and its elected officials. Anyone can get copies of emails sent to an elected official or access their calendar to see when they met with lobbyists. That transparency law still applies to the governor, local mayors and agency leaders across the state. But a provision in the budget bill now cuts off that access for anyone seeking records from state legislators and their staff. It says the lawmakers themselves can decide what to make public — and which documents to delete or toss in the shredder. “They have every incentive to leave you in the dark if there’s a record of something unflattering or that might not be politically advantageous to them,” said Brooks Fuller, executive director of the N.C. Open Government Coalition. “And my belief is that that’s probably what most legislators are going to do.” Legislative leaders wouldn’t say who asked for the provision to be added to the final draft of the budget. But House Speaker Tim Moore defended the change. “I think we received a public records request to every member of the General Assembly for every bit of correspondence for the last three years,” he said. “Now imagine how much that would cost to produce that. We get some kinds of requests like that routinely, that make no sense, that aren’t designed to get information. They’re designed to add to cost and harassment; it ends up costing the taxpayer’s money. So how do you balance that, with ensuring that the public has full transparency?” The longstanding public records law allows government agencies to charge a fee when a records request involves an “extensive” amount of staff resources. “Just because it’s inconvenient or time consuming or expensive, it’s not a good enough public policy reason to not allow free flow of information,” Fuller said. The move has few defenders outside the Legislative Building. The conservative John Locke Foundation, the N.C. Press Association and many Democrats have called for the language to be repealed. The change also removes transparency from the redistricting process underway this month. In the past, documents used in drawing new congressional and legislative maps were released after the new districts were approved. That won’t happen this year, prompting criticism from Rep. Tim Longest, D-Wake. “It shields precisely those records on matters where folks from both sides of the aisle have said we should be more transparent: Drawing district lines,” Longest said. Moore said the redistricting records may still end up becoming public through lawsuits expected to challenge the maps. As the legislature shuts off access to its internal workings, it’s giving its own staff far more power to get documents and information from other branches of government, as well as private companies that do business with the state. A few years ago, legislative leaders eliminated a nonpartisan agency that reviewed state programs and recommended improvements. That agency was replaced by investigators working directly for the leaders of a legislative panel, known as the Joint, also referred to as Gov Ops. It’s recently probed hurricane recovery programs and high school sports oversight, holding sometimes testy hearings with officials from Gov. Roy Cooper’s administration. A budget provision will let partisan staffers for the commission seize documents and enter offices of state agencies and government contractors. Sen. Graig Meyer, D-Orange, says the access is so broad that the partisan investigators could enter private homes of political opponents without a warrant, if they use their home as the headquarters for a business. He compares it to a spy agency. “The advent of this type of secret policing feels more like opening the door of authoritarianism and should scare us all,” he said, adding that the language requires people contacted by Gov Ops staffers to keep the interaction confidential. “Companies hoping to pursue growth plans in North Carolina may completely avoid our state if they believe that our legislative Gov Ops Gestapo will be digging into their private information or walking into their doors to demand access to their computer systems at any moment.” Republicans dismissed Meyer’s scenarios as hyperbole. They said the new authority for the agency is similar to what the state auditor uses to investigate government spending; the goal is to more effectively look at how state agencies and contractors are overseeing programs like hurricane recovery. “That’s just ridiculous,” Moore said of the ‘secret police’ claim. “There’s no arrest powers. There’s nothing like that.” But Brooks Fuller of the N.C. Open Government Coalition said it’s a concerning shift when paired with the repeal of public records laws. “This means that folks who already enjoy a lot of privilege and a lot of power as elected representatives in state government now have the ability to make public information laws, such as they exist, work for them,” he said. “And meanwhile, they’ve stripped that power away from average folks.” Reporters and others filed a few more requests to get lawmakers’ emails before the change took effect. It could be folks’ last chance for now.

Read more » click here

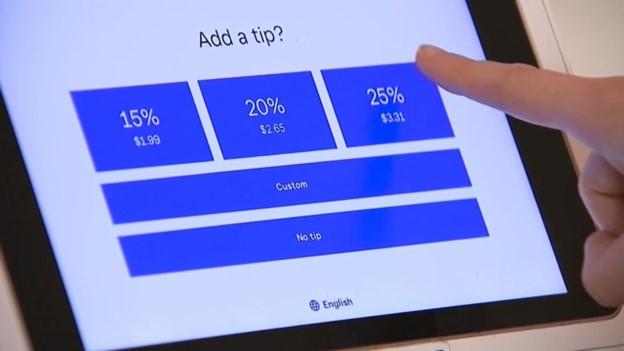

Americans are confused, frustrated by new tipping culture, study finds

The state of tipping in America is, in a word, a mess. Americans are divided and confused over when to leave gratuities and how much to tip for all kinds of services, according to a new study published Thursday by the Pew Research Center — and many don’t like recent trends such as added service fees and suggested tipping amounts. Drew DeSilver, the senior writer of the report, says the lack of consensus isn’t surprising given the ad hoc nature of the tipping regime in the United States. “Tipping is one of those things in American society where there aren’t clear rules,” he said. “There’s not a single generally accepted way of doing things, like with traffic lights, where we all know that red means stop.” If it seems to you that almost everywhere these days, from coffee shops to takeout spots, there’s an added service fee, you’re not alone. People are feeling “tipflation” — the proliferating number of workers to whom consumers are expected to pay gratuities — with 72 percent saying that tipping is expected in more places today than it was five years ago. Most don’t like the addition of “service charges,” the amounts that many restaurants and other businesses have tacked on to customers’ tabs under various names, often to cover the higher costs of things like food and labor — without having to raise their prices. An overwhelming 72 percent of people oppose them, with only 10 percent saying they favor them. And they are also more likely to oppose a suggested tip amount than favor it, something businesses have recently taken to putting on touchscreens at takeout spots or on printed bills — ostensibly to make calculating them easier, but often used as a prod to get customers to shell out. Forty percent of Americans oppose such suggested tips, while 24 percent favor them. (About a third neither oppose nor favor them.) But with more opportunities to tip, and with some restaurants and other businesses offering prompts, there’s still plenty of confusion about whether customers should leave a gratuity — and if so, how much. Thirty-four percent of U.S. adults say it’s “extremely” or “very” easy to know whether to tip for different kinds of services these days, and a similar share, 33 percent, say the same about knowing how much to tip. Interestingly, education and money aren’t always a help in this department: People with higher incomes and more education are more likely to express confusion about when it’s appropriate to tip, as well as what they should be leaving, according to the poll. While these recent and fundamental shifts in tipping might be confusing and unwelcoming, the survey also indicates that the practice in the bigger picture is divisive — Americans are not even on the same page about what tipping is. Twenty-nine percent of Americans think of tipping as an obligation, while 21 percent see it as a choice. Forty-nine percent, though, say it depends on the situation. Younger and more highly educated and wealthier people were more likely to see a tip as an obligation, Pew found. Advances in technology — like delivery apps and tablets at counters where you can tap to leave a gratuity — might be convenient, but they are contributing to the uncertainty. “It’s different than having a jar on the counter — people feel like they are presented with all these tipping options — but does that mean you are expected to tip?” DeSilver said. “We haven’t as a society settled on the rules for that.” When DeSilver went looking to see what kind of guidance people were being offered, whether in etiquette guides or in popular media, the results were all over the place, he said. And when Americans do open their wallets, it seems that many are, well, not great tippers. There are no hard-and-fast rules about how much to tip anywhere, of course. The standard, widely recommended rate has crept up steadily — while 15 percent used to be standard, many guides now suggest that 20 is the norm. But apparently, not everyone abides by that, according to the Pew poll. Given a scenario in which they experienced “average, but not exceptional” food and service at a restaurant, 57 percent of people said they would tip 15 percent or less. Two percent said they would leave their server nothing. Just about a quarter said they would leave 20 percent or more. Wealthier people tend to be better tippers, the survey found, while older people are slightly more likely to tip 15 percent or less — perhaps reflecting a holdover from the earlier standards on a sufficient gratuity. It’s not just customers who seem dissatisfied with the American tipping system, in which workers who regularly receive tips have an hourly wage that’s lower than standard minimums. Some labor activists say the system creates inequities and leaves workers more vulnerable to the whims of their employers. They also argue that relying on tips makes women — who make up the majority of the tipped workforce — more likely to suffer sexual harassment or abuse from customers and managers. The Pew Research Center survey was conducted Aug. 7-27 among 11,945 U.S. adults through Pew’s American Trends Panel and has a margin of sampling error of plus or minus 1.4 percentage points.

Read more » click here

Those tip prompts at checkout are now officially out of control

I was just leaving a new grab-and-go market in my neighborhood last weekend when the checkout screen suggested I add a tip. With an employee hovering about, I selected 10 percent. In my routine tipping fog, it took a few seconds before I realized that I had handed over an extra $1.70 on a bag of already marked-up coffee beans. The moment is a reminder that tipping is now out of control. Gratuity prompts have become so widespread and indiscriminate that a new study from the Pew Research Center shows it is causing mass confusion and frustration. We’ve been prompted to tip for any counter service for some time now, but nudges are now popping up at self-service kiosks at stadiums, airports and cafes. More is coming: Having new windows installed in your home? Tip it up, America. Before you call me a cheapskate, I’m not here to criticize or diminish the hard-working folks behind the counter — or the internet’s virtual service walls — or anywhere else. I blame the stingy employers that profit by making customers responsible for their refusal to pay a decent wage. Tipping has always been debated, but we broadly agreed on its purpose: A gratuity one gives after a service is rendered to reward the human effort and care demonstrably provided, in what is sometimes thought of as low-wage or underpaid work. We tip after the sit-down meal, after admiring our new haircut, after the bartender whips up a drink. We might tip a valet up front to take care of our car, but it is not necessary to do so to receive the service in the first place. Or at least, it wasn’t. It now seems that I can’t buy anything without being prompted to tip before service is rendered, upending the traditional why of tipping. Case in point: food delivery apps, where front-loading a tip is not only customary but necessary for the order to even be picked up. It’s a practice now referred to as no tip, no trip. To be clear, you might still receive the food late, cold, wrong, or not at all. But, by then, the tip is out of your hands and in someone else’s pocket. Some ride-hailing apps routinely ask for a tip soon after the trip begins. And some online purchases are turning our virtual carts into tip jars, too. Last week, a friend in Pittsburgh sent me a screenshot of a tip prompt from an Instagram shop after purchasing a cushion for an office chair. The prompt had invited him to “show some support for the team.” I am a lifelong tipper, regardless of the quality of service. I waited tables at Holiday Inn as a teenager and then at various joints in Tennessee to put myself through college. I consider bad tipping a good indicator of sociopathy. Servers are unfairly punished for mishaps far beyond their control, usually the result of a poorly run kitchen. The easy-to-tap buttons for 10, 15, 20 percent — in Los Angeles, often 30 percent! — have put tipping on autopilot. It may spare us the awkward math, but it also erases the pause for appreciation. The presence of a watchful employee has turned the act of tipping, even for subpar or no service, into a reflex rather than a reflection. We often tip simply to end the transaction, and businesses bank on that. Tipping has never been the right solution to unfair compensation. It has a racist and sexist past in which women and marginalized people were long made to bear the brunt of egregiously cheap employers. Studies show it offers little incentive to provide better service, and its continued practice does nothing to encourage employers to pony up and pay a decent wage. But let there be no confusion about who is at fault here. It is the companies who are betting that hurried consumers will subsidize what employers won’t pay themselves. It was the boss who paid me $2.13 an hour back in the day, with no benefits, and who demanded I share my tips with others so he could avoid paying my co-workers their fair wages, too. We can thank the pandemic for compelling society to better value the worker, but we will have gone backward if we’ve moved from tips for service to tips for transactions. (Who gets my 10 percent self-checkout tip, anyway, and for what?) One only need review what some companies say when asked to explain themselves: They point out that the tip prompt is optional. Well, here’s a better option. Employers: Pay your workers a living wage, so that tips become what they should be, an extra thank you for a service provided, not a stand-in for the lack of a fair paycheck itself.

Read more » click here

Tip a Self-Service Kiosk? How to Deal With the Many Requests for Tips.

Since the pandemic, they seem to be everywhere. And with inflation, the gratuity on a pricier meal feels like a big outlay.

If you feel that you’re being asked to tip more often, you’re not alone. Most American adults say tipping is expected in more places than it was five years ago, a recent survey from the Pew Research Center found. Once limited mainly to sit-down restaurants, hotel bellhop services and taxi rides, invitations to tip — with suggested amounts — now appear on checkout touch screens in more places, including casual restaurants without table service, mobile food trucks, delivery apps and even self-service kiosks. “People used to feel there was a line,” said Ismail Karabas, an assistant professor of marketing at Murray State University in Kentucky who has studied tipping. “It’s a lot more blurred, and it throws people off. Where do we stop?” A survey published in June by the financial website Bankrate found that two-thirds of Americans had a negative view of tipping, while about one-third felt that tipping culture was “out of control.” Ted Rossman, a senior industry analyst at Bankrate, said that what was meant to be a gesture of gratitude, or a reward for good service, felt increasingly like a surcharge. “The constant asks are rubbing people the wrong way,” he said. Mr. Rossman recalled encountering a tip screen this year at a self-checkout station at Newark Liberty International Airport. He was also taken aback when asked to tip at a pick-your-own strawberry farm. (He did, he said, because his wife was in favor of doing so.) “It’s becoming more of an exception not to be asked to tip,” he said. Replacing the old-fashioned tip jar, new digital payment systems have made it easy for businesses to ask customers for tips electronically. Michael Lynn, a professor of services marketing at Cornell University who has studied tipping, said people often leave gratuities for social approval, from the service provider or from fellow customers. So for some, it can feel awkward to tap “other amount” or “no tip” on a payment screen if they feel that the employee or others in line are watching. Under those circumstances, he said, people can feel coerced to tip, or guilty if they opt out. More generous tipping practices took hold earlier in the coronavirus pandemic, with people inspired to help frontline workers. But as the pandemic eased, higher inflation took hold, and tipping as a percentage of a pricier meal tab became more noticeable. The Bankrate survey found a general decline in the share of people who said they always tipped in certain situations, including for food delivery. There does, however, seem to be some consensus around when tipping is appropriate, the Pew survey found, notably at sit-down restaurants (92 percent of respondents said they “always” or “often” tipped there). That’s not surprising since tipping at full-service restaurants is an ingrained habit, Professor Karabas said: “People expect it. It’s an inherent part of the system.” In many states, the minimum wage for tipped employees is quite low, he said, and it’s generally understood that the servers “are working for tips,” so leaving a tip of at least 16 to 18 percent of the tab is justified. But diners aren’t necessarily being extravagant with tips these days, the Pew survey found. Asked how much they would tip for an “average” sit-down dining experience, the majority (57 percent) said they would tip 15 percent or less. Two percent said they would leave nothing. Just a quarter said they would tip 20 percent or more. The Pew survey found significant support for tipping after a haircut (78 percent), a food delivery (76 percent), buying a drink at a bar (70 percent) and using a taxi or ride-hailing service (61 percent). Tipping is less common in other situations, however, including when buying a drink at a coffee shop. Only about a quarter of people said they usually tipped in that situation. And the percentage was even lower (12 percent) for fast-casual restaurants. Yanely Espinal, director of educational outreach for Next Gen Personal Finance, which creates financial literacy courses for students in middle and high school, said context was important. It’s OK not to tip, or to leave a small tip, when running into a shop for a quick cup of coffee or tea to go, she said. But if it’s a shop you frequent often or you order a complicated drink, you might consider leaving one. “Use your judgment about when it makes sense,” she said. Overall, Pew’s survey found 43 percent of adults said they had worked in a job in which they received tips, and they were usually more likely to leave a tip. Professor Karabas suggests thinking about what you will do ahead of time. “Expect that you might be asked to tip and decide what you want to do, based on your own personal feelings and budget,” he said. As for how much to tip, check out the online guide at the Emily Post Institute, an etiquette firm in Waterbury, Vt., run by descendants of the manners maven Emily Post. Sample suggestions: While there’s no obligation to tip for takeout food that you pick up yourself, a 10 percent tip is appropriate for curbside pickup or for a large, complicated order. And for food delivery, aim for 10 to 15 percent of the bill — but $2 to $5 for pizza, depending on the size of the order and the difficulty of delivery.

Here are some questions and answers about tipping:

I don’t like feeling pressured to tip at checkout. What can I do?

Gratuities remain voluntary, with the arguable exception of sit-down dining because tips can be a big part of the server’s income, said Lizzie Post, a co-president of the Emily Post Institute. Should you receive subpar service at a sit-down restaurant, she advised tipping at least 15 percent but then talking to the manager. If suggested tips really bother you, Professor Lynn said, paying with cash instead of a debit or credit card can help you avoid them. If you’re prompted by a screen to tip in a nontraditional setting and you don’t feel that one is warranted, feel free to skip it. “Do you need to feel guilty?” Professor Lynn asked. “I don’t.”

If I tip at a self-service kiosk, who gets the money?

This varies, Professor Karabas said. Some businesses may pool tips for groups of workers, while others designate tips for the employee overseeing the checkout area when the tip was entered. (For instance, he said, he recently visited a “robotic” coffee shop in Seattle where the worker tending the shop explained that employees received the tips generated during their shifts.)

Should I tip more during the holidays?

Holiday tipping is “sort of a different beast,” Ms. Post said. “It’s really about saying thank you to service providers in your life at the end of the year.” That might include hairdressers, dog walkers and housekeepers. If you can afford to be generous, by all means do, she said. But if your budget is tight, she suggested giving a card or a personal note, saying you regret that you can’t tip this year, but expressing your thanks.

Read more » click here

This and That –

Fear the deer: Crash data illuminates America’s deadliest animal

Fear the deer: Crash data illuminates America’s deadliest animal

Behold the deer, the deadliest beast in North America. Deer are responsible for the deaths of about 440 of the estimated 458 Americans killed in physical confrontations with wildlife in an average year, according to Utah State University biologist Mike Conover, employing some educated guesswork in the latest edition of “Human-Wildlife Interactions.” Those deer-inflicted fatalities are not, so far as we know, caused by deer-on-human predation. They’re the unfortunate result of more than 2 million people a year plowing into deer with their sedans and SUVs, usually on a two-lane road, often at high speed. You might wonder: Where and when am I most likely to hit a deer? And how can I avoid it? To shed light on this herbivorous hazard, we turned, of course, to data. Specifically, we analyzed more than 1 million animal-vehicle collisions compiled by Calumn Cunningham, Laura Prugh and their colleagues at the University of Washington for a recent paper published in Current Biology. They estimate deer were involved in more than 90 percent of the collisions, which occurred in 23 states between 1994 and 2021. With a few exceptions, the data show deer are at their most dangerous in November. Indeed, the deer threat peaks just before Thanksgiving — typically Nov. 7 through 14 — when you’re about three times more likely to hit a deer than at any other time of year. Experienced deer hunters can probably guess why driving in November can turn into Russian roulette on certain highways and byways: In much of the country, that’s rutting season. And during the rut, deer focus on procreation, not self-preservation. Marianne Gauldin of the Alabama Wildlife and Freshwater Fisheries Division compares rutting bucks to teenage boys. “They are hyper-focused on the opportunity to breed, and they therefore lose some of their wits,” Gauldin said. “They are full tilt looking for does, chasing does and running after does for the opportunity to breed. And they are doing this with tunnel vision … literally running across the road.” Does share similar distractions. They’re either in estrus — hormonally receptive to sex and looking to breed — or fleeing hot-and-bothered bucks until their cycles catch up. Collisions occur more often in states with the most white-tailed deer — which experts say tend to have a shorter, sharper rut than the western mule deer — and in states with long stretches of busy rural roads. Separate insurance claim data from State Farm, which is widely cited in academic research, shows a driver out minding her own business on the wending, bending roads of West Virginia had a 1 in 35 chance of hitting an animal between June 2021 and June 2022, making the Mountain State easily the most dangerous in terms of deer-car collisions. Montana and Michigan were next. D.C. drivers, by contrast, had only a 1 in 907 chance of stopping a buck while driving down Pennsylvania Avenue, or anywhere else. Fun fact: Deer are responsible for at least 69 percent of animal-related accident claims, according to State Farm. Another 12 percent of claims involve unidentified animals, many of which could be deer that bounded off before the driver got a good look at them or were mangled beyond recognition in the crash. The third-most-dangerous animals on the road are undifferentiated rodents, which are cited in 5 percent of all animal-related accident claims. However, State Farm spokesperson Dave Phillips noted that many of the drivers never make contact with said rodent: The vast majority of those accidents occur when motorists swerve to avoid a suicidal squirrel or moseying marmot. Our more calendar-conscious readers will note that peak deer-crash season coincides with another big moment in November: the first week of daylight saving time, which begins the first Sunday of the month. And the University of Washington team has found that the two events are not unrelated. To understand why, we need to spelunk deeper into their data, which breaks new ground by including the exact location, date and hour of all these deer disasters. When we glance at a chart of accidents that includes time of day and time of year, one fact strikes us right between the headlights: Evening, the twilight of each day — especially in November! — is the hour of the Götterdeermmerung. Conveniently for us, the University of Washington scholars used accident coordinates and some basic weather math to calculate exactly when the sun would have risen or set at each location. It turns out that deer danger skyrockets about 30 minutes after sunset and remains extraordinarily elevated for almost half an hour. Those with deer-behavior expertise say drivers should be on high alert as darkness falls in autumn — especially when careening through the deer’s favorite transitional habitats, the forest-edge ecosystem created by roads and other developments. But they urge us to take a lesson from the thousands of people who land in hospitals and body shops each year after attempting to avoid a turtle or chipmunk: If you do see a deer, don’t swerve. “Slow down as much as you can, obviously, coming up to it,” said Karlin Gill of the National Deer Association, a hunting and conservation organization. “But if it’s unavoidable and you’re going to hit the deer, don’t try and swerve out of the way. That can cause an even worse car wreck, and you still might hit the deer regardless.” Deer crashes also rise in the morning, about 30 minutes before sunrise, but the number is significantly lower than after sunset. To understand why, we need to dig deeper into both deer and human activity patterns. Biologist after biologist told us deer are crepuscular, meaning they’re most active at dawn and dusk. When Texas A&M University wildlife scientist Stephen Webb and his colleagues fitted GPS trackers onto white-tailed deer in Oklahoma, they found deer movement peaks at both sunrise and sunset. “Deer, unlike humans, don’t lay down for eight hours at night and then get up and move throughout the day,” said Gill , who, as a hunter, closely examines deer behavior. “They actually go through a cycle where they’ll lay down, bed, get up, eat, lay down, bed, get up, eat, and they’ll do this throughout a 24-hour period.” But if deer are equally active at dawn and dusk, why are they so much more likely to be hit in the evening? To untangle that one, we need to examine another somewhat crepuscular species: the American commuter. Our commutes also peak in the morning and evening, but we’re much more likely to be driving at dusk than we are at dawn, and we stay on the roads even as darkness falls, and the deer start moving — often squarely into our headlights. It’s a matter of visibility. Deer are just as active two hours before dusk as they are two hours after, yet we’re about 14 times more likely to hit a deer after sundown than we are before. And, as Cunningham notes, right at the peak of the whitetail rut, we throw another variable into the stew: We end daylight saving time. Suddenly, as far as the deer are concerned, our 6 p.m. commute happens an hour later. Millions of drivers find themselves contending with lower visibility just as sex hormones flood the local deer population. “It’s like one of the grandest-scale natural experiments that we can come up with, where humans impose these very arbitrary and abrupt changes on the wildlife,” Cunningham told us from his native Tasmania (he’s at the University of Washington as a Fulbright fellow). People living on the far eastern side of a time zone are about 1.35 times as likely to hit a deer as folks on the far western edge, since folks in the east are more likely to be driving home in the dark. Similarly, folks in Northern states, where days are short and darkness rules the winter, are 1.86 times more likely to hit a deer than their friends in America’s sunny South. Taking these effects into account, the University of Washington team estimates that “falling back” causes a 16 percent jump in deer carnage in the weeks after the shift. It’s possible that adopting permanent daylight saving time would thus save the lives of more than 36,000 deer and 33 humans each year. On the down side, chronobiologist Eva Winnebeck of the University of Surrey argues that any gains might be offset by an increase in deaths spurred by the chronic drowsiness that would inevitably set in if our solar-powered circadian rhythms were forced to endure a never-ending disconnect between the sun and clocks set permanently to daylight saving time. Here at the Department of Data, we’ve found a strong connection between happiness and the great outdoors. So, we’re partial to any move that would give us more daylight hours to get out after work and fish, run or dominate the competitive wood-chopping circuit, circadian rhythms be darned.

Read more » click here

Watch out for deer

NCDOT warns motorists across North Carolina to stay alert for deer now that fall has arrived. Every year during late autumn, auto and body shops across the region brace for a bumper crop of business, comprised of an influx of cars with damage from collisions with deer. Beginning in October, roads across the state become hazardous as North Carolina’s deer population fans out, lurking on highway shoulders in search of food and potential mates. It’s the deadliest time of the year for deer, which also pose a particular danger to motorists. Nearly half of vehicle accidents involving white-tail deer occur from October to December. Deer accidents typically begin rising in October, peak in November and begin dropping off after December, according to the Insurance Institute for Highway Safety. Deer are crepuscular mammals, meaning they’re most active at dawn and dusk – which, following the onset of daylight savings time, places them near roads and byways precisely when large numbers of residents are commuting to and from work.

NCDOT has some helpful tips for motorists in regard to deer-vehicle crashes:

- Although it does not decrease the risk of being in a crash, wearing a seat belt gives you a better chance of avoiding or minimizing injuries if you hit a deer or other animal.

- Always maintain a safe amount of distance between your vehicle and others, especially at night. If the vehicle ahead of you hits a deer, you could also become involved in a crash.

- Slowdown in areas posted with deer crossing signs and in heavily wooded areas, especially during the late afternoon and evening.

- Most deer-vehicle crashes occur where deer are more likely to travel, near bridges or overpasses, railroad tracks, streams, and ditches. Be vigilant when passing through potentially risky landscapes.

- Drive with high beams on when possible and watch for eyes reflecting in the headlights.

- Deer often travel in groups, so if you see one deer near a road, be alert that others may be around.

- If you see deer near a road, slow down and blow your horn with one long blast.

- Do not swerve to avoid a collision with deer. This could cause you to lose control of your vehicle, increasing the risk of it flipping over, veering into oncoming traffic, or overcorrecting and running off the road and causing a more serious crash.

Officials say the most crashes occur between 6 p.m. and midnight, accounting for about 45% of the overall total. With the end of daylight savings time at 2 a.m. Sunday, Nov. 1, the time shift increases the chance of deer being by roadways when drivers are traveling in the dark, especially for their evening commute. If your vehicle does strike a deer, officials say do not touch the animal. A frightened and wounded deer can be dangerous or further injure itself. Get your vehicle off the road if possible and call 911.

Read more » click here

Factoid That May Interest Only Me –

| How the Real Estate Broker Business Could Change Industry experts say a federal jury ruling this week against the National Association of Realtors and large brokerages makes the current commission model likely to change. A federal jury dealt the biggest blow to the American home-buying industry in perhaps a century this week when it found that the powerful National Association of Realtors and several large brokerages had conspired to keep agent commissions artificially high. Brokers, analysts and consumer advocates called the decision — which awarded plaintiffs nearly $1.8 billion in damages — a game changer. More antitrust lawsuits against the association and brokerages are awaiting trial, while federal regulators are looking to intervene as well.Here’s what changes might be in store for the home brokerage industry, which pulls in an estimated $100 billion in commissions each year.Real estate experts say the current system won’t stand. Right now, home sellers essentially pay fees for both their own agent and the buyers’ agent, with a typical commission around 5 to 6 percent, split between the two brokers. That structure is largely enforced by the National Association of Realtors, which has about 1.5 million dues-paying members. If a seller doesn’t agree to those terms, the listing isn’t shown on the multiple listing services that underpin most home sales. This week’s decision may have changed that. “The industry can no longer believe that any jury will decide in favor of their price-setting system,” Steve Brobeck, senior fellow at the Consumer Federation of America, told DealBook. Experts identified a range of potential shifts, including: · Making commission sharing optional, so that sellers’ agents who don’t want to pay buyers’ agent fees can still list on databases. According to analysts at the investment bank Keefe, Bruyette & Woods, as much as 30 percent of the industry’s commissions could disappear. Start-ups are trying different business models. The brokerage industry could contract. |

How real estate commissions work and why they might get lower

A new court verdict could upend how agents get paid. Here’s what it all means for buyers and sellers.

When you sell a house, both your agent and the buyer’s agent get a slice of the pie. But just how big of a slice is a question snaking its way through the courts. A jury in Kansas City this week found that the National Association of Realtors and a number of real estate brokerages conspired to keep home sale commissions artificially high. Defendants, who have pledged to appeal, are on the hook to pay nearly $1.8 billion in damages to about a half-million Missouri home sellers, and that amount might grow. The outcome could totally upend how real estate agents get paid, and how homes are sold. But to understand how things may change, we first need to clarify just how the system works.

How do real estate commissions work?

Most real estate agents make their money from commissions. In the United States, there’s generally an agent representing the seller and one representing the buyer. The seller pays the commission to both of them. This has been standard practice for more than 50 years, according to Christy Reap, spokesperson for Bright MLS, the database of homes for sale in the Mid-Atlantic. Generally, commissions are 5 to 6 percent of the home-sale price. The buyer’s and seller’s agents split that money. So, if a home sells for $500,000 with a commission of 6 percent, the agents on both sides of the deal will split about $30,000 from the proceeds of the sale.

What’s the problem with the status quo for agent commissions?

A seller and their agent cannot cut the buyer’s agent out of the commission without facing big consequences. This requirement to “couple” the commissions — or else — is one of the standards under fire in the lawsuit. The seller’s defendants claim it amounts to forcing them, unfairly, to pay both commissions. So, what’s the penalty if you don’t comply? In most parts of the country, in order to get a property on the multiple listing service (MLS) — the essential database of homes for sale that also populates other platforms such as Zillow and Redfin — a selling agent must agree to share their commission, (common practice is 50/50). If a home is barred from being listed on the MLS, it becomes nearly invisible to potential buyers. Some industry watchers identify other problems with the commission structure, too, even though these issues aren’t part of the lawsuit. First, the way that people shop for homes has changed dramatically, thanks to the amount of information available on the internet. You don’t need a real estate agent to show you which houses in your town are for sale, or to see a list of comparable sales. In other words, the work required of real estate agents has arguably decreased, yet commissions have not changed to reflect that. “When we look at the data on commissions, what we see is that they’ve remained remarkably stable in a range of 5 to 6 percent, even though the role of the buyer agents in particular has changed significantly over this period,” says Sam Chandan, the director of the NYU Stern Chao-Hon Chen Institute for Global Real Estate Finance. Secondly, industry watchers question the one-size-fits-all approach to commissions. “Economists think it’s very odd that the commission is the same for every deal because objectively, some deals are harder than others,” says Jenny Schuetz, a senior fellow at the Brookings Institution focused on housing. “Some customers are harder to deal with, or some houses take longer, or the negotiations are more complicated, and that’s not reflected in the commission.”

What would be the downside of changing the status quo?

Reap, the spokesperson for Bright MLS, contends that the practice of splitting commissions prevents favoritism and unfairness among agents. Without adhering to it as an industry-wide standard, she predicts agents will be incentivized to do more deals and refer more business to their peers who continue to split commissions, and ice out those who don’t. Buyers or sellers represented by an agent in the latter camp would then also be disadvantaged. Reap also points out that forcing buyers to pitch in with commissions would put them “at a significant disadvantage.” Adding that expense on top of the down payment and other closing costs already required of buyers, she says, raises the question: “How is a buyer going to be able to pay for quality representation on the most expensive transaction of their lives?”

Even though the standard is about 6 percent, can a seller negotiate a lower commission with their agent?

Technically, yes. You can negotiate an agent’s commission before you enter into an agreement to have them sell your home. However, most people don’t. “A lot of people just don’t question it,” Schuetz says. “[Selling a home] is a big transaction. People don’t do it very often. It’s going to be super expensive whatever you do, and a whole bunch of people you’ve never heard of before are going to get a piece of the action.” It’s precisely this level of complication that compels many people to use real estate agents in the first place. And some sellers worry that lowering the commission will make buyers’ agents less likely to bring around their clients. Think about it: If every other listing promises the buyer’s agent half of 6 percent, but your home only offers half of 4 percent, that agent has less incentive to convince their client to buy your place. This fear among sellers is well-founded. “There’s a considerable body of evidence to show that buyers’ agents are more likely to present properties to buyers that offer a higher commission rate,” Chandan says. (The recent lawsuit focuses on how the large institutions in the marketplace, such as the National Association of Realtors and larger brokerages, facilitate this behavior.)

Some brokerages, like Redfin, offer lower commissions. How do they do that?

Redfin works differently than many traditional brokerages because it directly employs its agents and offers them a base salary on top of their transaction bonuses. So, people who sell a home through Redfin don’t pay their agent a commission — instead, they pay a “listing fee” between 1 and 1.5 percent. But many other brokerages that pledged lower commissions had a difficult time breaking into the market. According to a study from the Wharton School, new companies paying lower commissions grew more slowly than ones that offered higher commissions.

Will anything change for home sellers right now because of this verdict?

No. The lawsuit itself will face appeals before its outcome is clear. But that doesn’t mean the industry will remain the same until all of the legal matters are settled, either. For one thing, given the risk of getting roped into a similar lawsuit, some brokerages may make proactive changes to their commission structure. Redfin CEO Glenn Kelman said in a statement that the lawsuit will “ensure major change” comes to the real estate industry, including, potentially, that buyers will start to pay their own agents’ commission, or that buyers and sellers could more commonly share the same agent, as they do in Great Britain, Australia and New Zealand. Chandan believes that decoupling buyer and seller commissions could create more competition and variety in the market. “There’s research to suggest or show that we will see more competitive house prices … and more competition among buyer’s agents,” he says, along with the emergence of technology and platforms that could support buyers who forgo a traditional agent. It could cause real estate agents to change their scope of work, rather than offering one blanket service at the same fee, Schuetz says. “You could have agents who specialize in sort of higher and lower service levels and price accordingly,” she says. For example, a buyer who doesn’t need help finding a house but wants assistance crafting an offer could, in this hypothetical, pay less than a buyer who needs both services. While this could save people money, it could also lead to discrimination, Schuetz notes. “You could wind up having a specialization where some agents choose only to work in some neighborhoods, or at some price points, or with certain kinds of customers.” But really, she says, there are a lot of unknowns: “There could be a bunch of changes to the industry, and we won’t know what those are going to look like until they happen.”

Read more » click here

How the cost of homebuying and selling will change after landmark court loss over real estate commissions

- The recent $1.8 billion jury verdict against the National Association of Realtors and several top brokerage firms highlights mounting legal and market pressures on real estate commissions.

- A recent Keefe, Bruyette & Woods analyst report estimated that the $100 billion paid in real-estate commissions annually could be cut by 30%, with as many as 1.6 million agents losing their source of income.

- Commissions are already negotiable, but buyers agents are likely losers as homebuyers are more likely to bypass them, or in the least, negotiate for lower fees.

A recent jury verdict against the National Association of Realtors and large residential brokerages could upend the residential real estate industry. The real estate compensation model is at the heart of the issue. Plaintiffs contend that commission rates are too high, buyer brokers are being overpaid, and NAR rules, along with the corporate defendants’ practices, lead to fixed pricing. By contrast, NAR contends the rules promote competition and efficient, transparent and equitable local broker marketplaces. NAR, whose CEO left shortly after the landmark court loss, is appealing the $1.8 billion jury verdict, so it could be several years before the case — which covers the Missouri markets of Kansas City, St. Louis, Springfield and Columbia — is resolved. But coupled with similar lawsuits that are in process, the potential for policy changes that could impact realtors’ pocketbooks is palpable. The impact on the market continues to spread. Shares of Re/Max Holdings, for example, were down over 8% on Tuesday amid fears of litigation, even though it had settled with plaintiffs before the recent NAR case verdict.

Here’s what real estate agents, homebuyers and sellers need to know about potential changes in residential real estate economics.