Lou’s Views

News & Views / January Edition

Calendar of Events –

NA

Discover a wide range of things to do in the Brunswick Islands for an experience that goes beyond the beach.

Discover a wide range of things to do in the Brunswick Islands for an experience that goes beyond the beach.

For more information » click here.

Calendar of Events Island –

Shag Lessons

The Town of Holden Beach will offer shag lessons at the Holden Beach Chapel on Thursday evenings beginning February 29th and going through April 4th. Cost is $60 for residents for the series and $70 for non-residents. Beginners’ classes will run from 5:30 – 6:15 p.m. and intermediate from 6:15 – 7:00 p.m. You must have a dance partner in order to sign up. The instructor for the class will be Chuck Boney. Register by emailing Christy at [email protected] with your name, phone number and whether you are interested in the beginner or intermediate class.

Pickleball Classes

Pickleball Classes

Pickleball classes will be held every Monday starting at 10:00 a.m. for beginners, 11:00 a.m. for intermediate and every Tuesday starting at 4:30 p.m. for ages 12-17, 5:30 p.m. for beginners, 6:30 p.m. for intermediate, and 7:30 p.m. for advanced, from March 18th through May 7th at Bridgeview Park. Cost is $100 for the season for residents and $110 for non-residents (or $180 for two classes per week for the season for both residents and nonresidents). For more information click here.

Parks & Recreation / Programs & Events

For more information » click here

Reminders –

Solid Waste Pick-Up Schedule

GFL Environmental change in service, trash pickup will be once a week. This year September 30th was the the last Saturday trash pick-up until June. Trash collection will go back to Tuesdays only.

Please note:

. • Trash carts must be at the street by 6:00 a.m. on the pickup day

. • BAG the trash before putting it in the cart

. • Carts will be rolled back to the front of the house

Solid Waste Pick-up Schedule – starting October once a week

Recycling – starting October every other week

Curbside Recycling – 2024

GFL Environmental is now offering curbside recycling for Town properties that desire to participate in the service. The service cost per cart is $106.88 annually paid in advance to the Town of Holden Beach. The service consists of a ninety-six (96) gallon cart that is emptied every other week during the months of October – May and weekly during the months of June – September.

Curbside Recycling Application » click here

Curbside Recycling Calendar » click here

Recycling renewal form was sent, you should have gotten e-mail letter already

Upon Further Review –

Bike Lane

Bike Lane

Property owners along Ocean Boulevard were sent a CAMA notice from the DOT

.

Key takeaways:

- Add 7’ asphalt to the south side of existing pavement

- Add 3’ asphalt to the north side of existing pavement

- Recenter the travel lanes

- Create two (2) five (5) foot bike lanes on either side of the road

DOT informed us the cost of the has significantly increased by almost 30%

The good news is that our portion is only an additional $23,000 so far

Previously reported – October 2023

DOT Bike Lane Report Presentation » click here

The plan includes bike lanes of 5’ on each side of Ocean Boulevard. It will be an asymmetrical widening, that is 7’ on the south side and only 3’ on the north side where the sidewalk is.

Highland Paving has been awarded the contract and has already met with the town staff

Surveying has already been completed and work on storm water issues will begin in November

Paving prep work will start once that is completed, probably sometime in December

They anticipate that the actual paving project will be done beginning March

Work will be done starting from the west end of the island working east

They are still committing to completing the project before Memorial Day

THB Newsletter (10/20/23)

Ocean Boulevard Resurfacing and Bike Lane Project

Highland Paving met with the Department of Transportation and staff last week to discuss the upcoming project. They communicated that storm water work will begin in November. The subsequent paving prep work, which we are thinking will take place in December, will involve removal of the road shoulders, three feet on the north side of the road and seven feet on the south side of the road. We do not know where the contractor will be at any given point in time. Property owners are responsible for removing any material (landscape timbers/specialty rock, etc.) from the construction area that they don’t want hauled off by the contractor. Replacement material will be generic ABC stone. Mailboxes will be moved/reset, but if they fall apart, the contractor will install a generic replacement. We are forecasting the paving won’t begin until March/April, with the project being completed by Memorial Day.

THB Newsletter (12/21/23)

Ocean Boulevard Resurfacing and Bike Lane Project

Paving prep work for the project will involve removal of the road shoulders, three feet on the north side of the road and seven feet on the south side of the road. Work is scheduled to start in the beginning of January. Make sure to remove any materials before this time. Property owners are responsible for removing any material (landscape timbers/specialty rock, etc.) from the construction area that they don’t want hauled off by the contractor. Replacement material will be generic ABC stone. Mailboxes will be moved/reset, but if they fall apart, the contractor will install a generic replacement.

THB Newsletter (01/16/24)

DOT Resurfacing and Bike Lane Project

The contractor will start moving mailboxes and street signs this week. Mailboxes will be relocated to the far edge of the right-of-way. Mail service is not expected to be impacted. Subsequent work on clearing material from the right-of-way is scheduled to begin once this work has been completed.

Corrections & Amplifications –

Holden Beach Causeway – Facebook

Sometimes change is out of our control but if we recognize it in time, we can help influence change to have a positive outcome. Our community is special and no longer a secret. The area’s population increase is happening at a rapid pace. The Holden Beach Causeway has become insufficient to meet today’s demand. Spend a little time on the Causeway and it is easy to see it is unsafe for pedestrians and vehicles entering and exiting the local businesses. The crash rating on the Causeway is three (3) times higher than the NC state average for similar roads. Since 2018 I have persistently advocated for a study on developing the necessary changes needed on the Holden Beach Causeway. The Holden Beach Causeway Corridor Study was approved and funded in 2019. The study was developed with the influence of the Causeway property owners working with Brunswick County Planning, the North Carolina Department of Transportation and the Grand Strand Area Transportation Study (GSATS). A special thank you to the Causeway Property Owners who were a part of the Causeway Study Steering Committee. Lyn Holden, Gina Robinson, Steven Parish, Joe Shannon, Andrew Robinson and I dedicated a lot of time working on the study. Communicating with other Causeway property owners and representing what is right for our community, to prevent an unwanted outcome. The steering committee involved Tri-Beach Fire Department in the conversations. Including their opinions on the study’s development to assure they had sufficient access through the Causeway and to the island for emergency response. All headed up by the carefully chosen consulting firm, Bolten and Menk. The consulting firm did an amazing job working with all of the obstacles on the Causeway, consulting with the steering committee and business owners about their concerns of any negative impacts from the project. We are proud to present to you the Holden Beach Causeway Corridor Study. Please visit the link below to review the final draft. Considering all of the obstacles and considerations for everyone, the outcome offers a bright future for our community. It also provides a path for sustainability and safety for our Causeway and its businesses, as our area continues to grow.

What happens next?

Chairman to the Brunswick County Board of Commissioners, Commissioner Randy Thompson, has requested an endorsement for the Holden Beach Causeway Project from the Town of Holden Beach. Commissioner Thompson’s position for requesting the Town endorsement is the Causeway is the highway ingress, egress to the island. Next, the study will be presented to the Brunswick County Board of Commissioners for endorsement. Once the study has been endorsed by Brunswick County, the study will go back to the Grand Strand Area Transportation Study for adoption. Once adopted by GSATS, we can begin applying for Funding. It has been a long road to get to this point and we have a long road ahead to receive funding and begin construction. Thank you all for your support for the Holden Beach Causeway Project. We will need your continuous support as we navigate through the next phase of this process. I will keep this page posted as developments are made with the County required endorsements and the road to GSATS adoption.

Jabin Norris president of PROACTIVE Real Estate

For more information » click here

HB Causeway Study Report » click here

THB Newsletter (01/25/24)

Holden Beach Causeway Study

The Grand Strand Area Transportation Study MPO (GSATS) funded a study to improve the Holden Beach Causeway by observing the area and addressing the concerns of Causeway business owners and patrons as well as the community related to vehicular and pedestrian safety, accessibility, right‐of‐way encroachments, and parking deficiencies. This study provides insight as to how the corridor functions and ideas for future improvements from a transportation and land use perspective.

For more information and to view the study, visit the Brunswick County Planning Department’s website: https://www.brunswickcountync.gov/409/Holden-Beach-Causeway-Transportation-Cor

The Draft Holden Beach Causeway Transportation Study will go to the Brunswick County Board of Commissioners for a public hearing and for their consideration on February 5, 2024, at 3:00 p.m.

Previously reported – February 2023

A popular Brunswick beach road could soon see needed improvements.

Here’s the first step.

A popular Brunswick County road could see much-needed improvements if a project more than four years in the making gets its final go-ahead. Since 2019, Holden Beach residents have pushed local and state leaders to fund a study looking at the Holden Beach Causeway, the business strip on the mainland side of Holden Beach. Now, with a contractor in place and funding squared away, state and local leaders are eager for the study to get underway.

Here’s what to know as officials await the green light to begin.

What will be studied?

The Grand Strand Area Transportation Study (Myrtle Beach Metropolitan Planning Organization) is leading the Holden Beach Causeway Study. The GSATS MPO study area boundary encompasses the northern coast area of South Carolina, including portions of Horry and Georgetown counties, and the southern coastal area of North Carolina including portions of Brunswick County. According to Marc Hoeweler, MPO Director at GSATS, the study will focus primarily on access management by studying existing rights-of-way and driveways and how they can best be structured and ordered for better traffic flow. Hoeweler said the project was prompted by a request from the county. The study would also address pedestrian safety concerns and parking deficiencies. Following its completion, the study would serve as a guide for future road improvements and development along the causeway.

What is the cost?

The $40,000 study will be funded with both federal and local dollars. According to Hoeweler, 80% (or $32,000) will be funded by federal money, while a 20% (or $8,000) local match will be provided by Brunswick County.

What’s the hold up?

According to Brunswick County officials, GSATS is currently working with the North Carolina Department of Transportation to finalize the contract with the consulting firm. Following a “competitive” selection process, Minnesota-based engineering firm Bolton & Menk was selected for the project. Once a final contract is signed by all parties, work on the study will begin. Hoeweler said he expects approval any day now and a kickoff meeting could occur within a week of the contract being signed.

Read more » click here

Bridge lanes to be closed for months during repairs

A preservation project, to extend the life of the Cape Fear Memorial Bridge, will temporarily close portions of the bridge in the coming months. Built in 1967, the Cape Fear Memorial Bridge is reaching the end of its lifecycle and must be monitored, inspected and maintained on a more frequent basis. Daily inspections of the steel vertical-lift bridge have shown the need to conduct longer-lasting improvements. The work scheduled to begin in early 2024 will repair the moveable bridge deck. Weather and material dependent, the eastbound lanes heading into Wilmington will close as early as Jan. 3. The westbound lanes will remain open to traffic. During this closure, those wanting to drive into Wilmington will detour to take the Isabel Holmes Bridge to Martin Luther King Jr. Boulevard to College Road. The bridge is scheduled to be open in both directions on April 1-7 for the North Carolina Azalea Festival in downtown Wilmington. Tentatively, on April 8, contract crews will close the westbound lanes to traffic and reopen before Memorial Day. The contractor, Southern Road & Bridge LLC, was awarded the $7.1 million contract on Nov. 30. The department has incentivized the company to finish early, potentially earning an extra $500,000. The N.C. Department of Transportation will continue to update the public as more information becomes available. For real-time travel information, visit DriveNC.gov or follow NCDOT on social media.

Read more » click here

Local officials, DOT squabble as Cape Fear Memorial Bridge lane closures loom

The DOT intends to close traffic in one direction over the Memorial Bridge for months at a time, starting as soon as early January, to allow much-needed repairs to the bridge’s moveable mid-section

Wilmington Mayor Bill Saffo was fuming. In early January, the N.C. Department of Transportation (DOT) intends to shut down both lanes of the Cape Fear Memorial Bridge carrying traffic from Brunswick County into Wilmington for several months. After reopening the bridge in both directions in early April for the N.C. Azalea Festival, the lanes into Brunswick County from the Port City will be closed until Memorial Day − roughly seven weeks. With the Memorial Bridge carrying more than 72,000 vehicles a day, the move means thousands of Brunswick County commuters and other drivers will have to find a new route to reach businesses, shops, medical facilities, family and friends on the New Hanover County side of the Cape Fear River. The mayor of Wilmington said only formally announcing the work Dec. 1 via a news release that the state intended to shut down lanes on the city’s main bridge crossing for an extended period was unacceptable. “I’m not sugarcoating it,” Saffo said recently. “This isn’t a problem created by local governments. This is a problem created by the state government, and they should have been at the table a lot earlier.”

‘Tough situation’

The need to replace the Memorial Bridge, which opened to traffic in 1969, has been a slow-moving crisis for decades that’s about to hit the front burner. While New Hanover and Brunswick officials for years and even decades have been unable to agree on many aspects of a new crossing, including where it should go and how it should be financed, the DOT has been crystal clear there isn’t enough money in the agency’s budget to build a new bridge and associated roadway infrastructure without outside funding sources − whether tolls, a local revenue source, a public-private partnership or federal help. But local officials, backed by many residents, have shown little appetite for tolls to replace a bridge that’s currently free to cross, and efforts to increase the region’s sales tax rate like Myrtle Beach and Charleston did to build new transportation infrastructure have gone nowhere. The DOT also has been vocal, especially in recent years, that the clock is ticking on how long they can keep the bridge operational as container truck traffic and overall traffic volumes continue to climb. But Saffo and other local officials have pushed back against the DOT, noting a lot of the wear and tear the state-owned bridge is seeing is due to the rapid growth the state-run Port of Wilmington has seen in recent years. They also point to projects in other parts of the state the DOT is constructing through traditional, non-tolling ways to deal with growth and congestion. “This is putting us in a really tough situation,” Saffo said, of the impending lane closures. “We’re trying to accommodate the port, the state, but also trying to protect the residents of those communities that are going to be impacted by this closure, and with all the impacts this is going to cause I feel strongly that we would have had a lot more discussion, outreach efforts on the DOT’s part than what we’ve seen.”

DOT: Local officials were aware

At a recent New Hanover County Board of Commissioners meeting, county officials raised similar concerns about a lack of communication from the DOT. Commissioner Jonathan Barfield called the state’s lack of public outreach a “dereliction of duty to our community,” while Commissioner Rob Zapple said he didn’t understand why the repair work was going to take so long when major infrastructure projects with significant impacts in other parts of the country get done in a much shorter time span then what’s being proposed with the bridge deck repairs. But DOT officials, who didn’t attend the commissioners’ meeting, have pushed back against the criticism. They’ve said the agency has made presentations about the upcoming project and the need for the work at several monthly meetings of the Wilmington Metropolitan Planning Organization (MPO), which is made up of elected officials from the region and helps guide transportation policy and priorities for the Cape Fear area. Several local media outlets, including the StarNews, also reported about the upcoming lane closures this summer and early fall. In response to questions about why both lanes in one direction need to be shut at a time, the DOT has said it’s the only way to replace the support beams for the bridge’s riding deck, since it requires removing part of the roadway. The riding deck is the open-grated steel deck in the middle of the Memorial Bridge that is raised to allow tall ships to pass under the span.

‘A bitter pill’

With no easy or fast solution and a lot of immediate traffic pain in sight, there are few easy answers for Wilmington and Brunswick County residents about to be consumed by gridlock. While acknowledging the failures of local officials in past years to agree on a plan forward and the DOT unable or unwilling to commit the funds necessary for a new bridge, state Rep. Deb Butler said it’s going to be a tough first few months in 2024. “This is one of those big, Herculean infrastructure projects that’s going to be disruptive,” said the Wilmington Democrat, whose district includes the city’s downtown area. “It is, it just is. If we want a new bridge, we better understand that all of us are going to be dissatisfied a little bit. It’s just a bitter pill we’re all going to have to swallow.” But Butler said she was confident that state and local officials will be able to navigate a path forward to building a replacement crossing. “I believe if Charleston (South Carolina) and Savannah (Georgia) can do it, we can do it,” she said, referring to two Southern coastal towns like Wilmington that have built new downtown bridge crossings in recent decades. “I firmly believe that in my heart.” While a new replacement Memorial Bridge might still be years off, there’s at least one piece of good news. The DOT’s $7.1 million contract for the deck-replacement work includes significant financial rewards for the contractor to get the work done early. A similar incentive offer helped get the new high-rise bridge in Surf City, which opened in 2018, completed 10 months ahead of schedule. Staffers with the DOT and several local governments, including Wilmington and New Hanover and Brunswick counties, also intend to meet weekly, starting Tuesday, to flush out emergency response, public communication efforts and other plans for when the bridge lanes are closed. At the recent commissioners’ meeting, County Manager Chris Coudriet also said that while Jan. 3, 2024, was the first day the contractor could start work, DOT officials have said that didn’t necessarily mean that’s when the lane closures would take place. “What was made very clear around the table by city and both county staffs is we need plenty of advance notice if it’s not going to be Jan. 3, what date is it so that we can communicate and prepare our communities,” he told the commissioners.

Read more » click here

‘Quite the mess:’ Cape Fear Memorial Bridge lane closures to impact local businesses, employees

More than 60,000 vehicles cross the Cape Fear Memorial Bridge each day according to the North Carolina Department of Transportation. Starting as soon as Jan. 3, both lanes on the bridge heading into Wilmington will close so crews can make repairs to the moveable deck. After those repairs are complete, NCDOT officials say those lanes will reopen, and the lanes into Brunswick County will close. The repairs could last until Memorial Day. Wilmington Urban Area Metropolitan Planning Organization Deputy Director Abby Lorenzo says the organization has been working with local businesses to prepare for the upcoming traffic. NCDOT officials expect traffic to be detoured across the Isabel Holmes Bridge and I-140. While this is sure to cause delays, Lorenzo says the best way to limit headaches is to reduce the number of cars on the road. “If you have the ability to shift when you’re out on the road traveling if you have the opportunity to go with your neighbors to the grocery store or whatever trip you may have planned, those are all eating and removing those vehicle miles traveled,” Lorenzo said. Lorenzo says WMPO’s Go Coast program can help people understand how to use alternate forms of transportation to get where they need to go. “Every trip saved, even if it seems like a minimal low impact, it is helping,” said Lorenzo. “[But] it’s not going to mitigate all the congestion we’re going to see.” Laurie Anderson is a teacher who lives in Leland but works in New Hanover County. She says she is already planning to leave an hour earlier than usual to get to work once the repair work begins. “I am going to try starting an hour early to get to just the other side of the Cape Fear Bridge which is normally about 12 [minutes]. I’ll start at 6 a.m. but if there’s an accident who knows what will happen,” Anderson said. The lane closures and inevitable traffic are also likely to impact businesses on both sides of the bridge. While Lorenzo and WMPO officials have suggested remote work as an option to reduce traffic, that is not an option for Anderson or Waterline Brewing Company Owner Rob Robinson. Robinson says the repair work will impact his business- and others nearby- in more ways than one. “I think that the bridge closure is going to have kind of a subtle effect, not just the overt effect,” said Robinson. “It’s going to create traffic problems in the drive across for the businesses like us that do deliveries, but I think it’s also going to impact the number of people that might just stay home instead of going out.” NCDOT Engineer Chad Kimes says the bridge repairs need to be done before the summer to avoid the possibility of having to shut the entire bridge down. Robinson, meanwhile, hopes that the repairs will not make the slow season even slower. “We get a lot of people that come to visit us and the rest of downtown from Brunswick County and from Leland and they come across the bridge and so, going all the way around to Isabel Holmes is going to be quite the mess,” Robinson said. NCDOT awarded a $7.1 million contract to Southern Road & Bridge LLC for the project. The company can earn an additional $500,000 if the project is finished early.

Read more » click here

Detour ahead:

These are your options for getting to Wilmington when the bridge closes

The Cape Fear Memorial Bridge’s upcoming lane closures have caused a lot of commotion among residents and elected leaders in recent weeks. The eastbound lanes heading into Wilmington will close on Jan. 11 for roughly three months, though the westbound lanes will remain open to traffic until April 8. The cause for the lane closures comes from the much-needed moveable bridge deck repairs. While long-overdue, such preservation repairs on the more than 40-year-old bridge are likely to cause major traffic delays for those who rely on it to access Wilmington. “This is going to be a tremendous nightmare” going up and down Front Street, MLK Parkway, College Road and Shipyard Boulevard, New Hanover County Commissioner Jonathan Barfield said recently. “It’s going to be pretty much gridlocked for a lot of individuals.” The N.C. Department of Transportation detour will have motorists taking the Isabel Holmes Bridge to Martin Luther King Jr. Parkway and then to College Road. Here are some other alternate routes. They may take additional time and planning, but they will allow drivers to avoid traffic tie-ups expected at the Isabel Holmes Bridge. From Leland to Wilmington: Instead of taking the Isabel Holmes Bridge, consider taking I-140 to U.S. 117. This will eventually connect to College Road but will avoid much of Martin Luther King Jr. Parkway. From Southport to Wilmington: Consider taking the Southport / Fort Fisher Ferry to U.S. 421, and then connecting to U.S. 117. Estimated time: About one hour. From southern Brunswick County (including Shallotte and Oak Island): Taking the NCDOT detour might be the best option. Alternatively, drivers could use the Southport Ferry or travel north to I-40 toward the Castle Hayne and Northchase area. But these extensive routes would take around an hour and a half to two hours of travel time. From Castle Hayne to downtown Wilmington: While those coming from Castle Hayne won’t have to worry about crossing any major bridges, if drivers are looking to avoid Martin Luther King Jr. Parkway and College Road, taking I-40 to Gordon Road, and then to U.S. 17 could be a good option. Estimated time: About 30 minutes.

What’s next?

According to NCDOT, the bridge is scheduled to be open in both directions on April 1-7 for the Azalea Festival. On April 8, westbound lanes on the Cape Fear Memorial Bridge will be closed to traffic and should reopen sometime before Memorial Day.

Read more » click here

Buckle Up!

Odds & Ends –

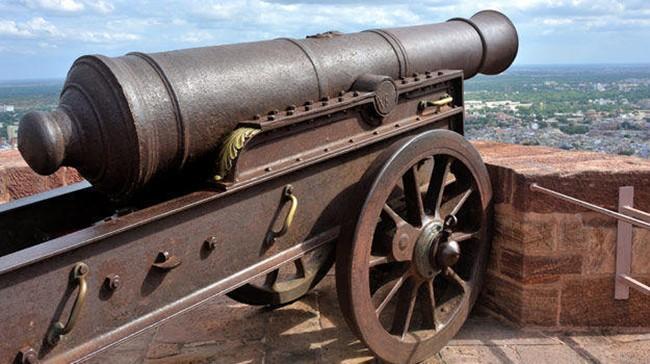

What are the Seneca Guns?

Could they be earthquake rumbles or ghostly echoes?

For decades, residents along the Cape Fear coast have reported hearing mysterious booms. What sounds like loud explosions are typically heard several times a year, which often sets off a flurry of rumors on social media. The puzzling vibrations, which rattle homes and shake the ground, are referred to as the Seneca Guns.

Where did the name come from?

The name may be misleading, as it doesn’t refer to actual firearms. The term Seneca Guns originated to describe a phenomenon in New York, describing booms near Lake Seneca in the Finger Lakes region, according to the United States Geological Survey. Overtime, this term has transcended its origins and is now commonly used across the Carolinas and Virginia to characterize similar unexplained events.

What causes the loud booms?

The origin remains a mystery, prompting North Carolina residents to frequently speculate on possible causes.After an unexplainable boom startled numerous Brunswick residents in 2022, UNCW Environmental Sciences Lecturer Robert D. Shew provided some insight into the matter. “Seneca Guns have been heard mostly near the coast but inland as well and they have been reported for many years,” Shew said. “Unusual sources of the sound have been given as earthquakes, bolide (meteoroid) breakup above ground, and military operations.” Despite the military consistently refuting the claim, some still attribute the sounds to off-book military testing and training activities happening offshore.

Could the phenomenon be supernatural?

Some attribute the phenomenon to supernatural claims, proposing that the mysterious sounds could be echoes of cannon fire from the Civil War 158 years ago. Alternative theories propose the events might be linked to the shifting of tectonic plates under the ocean floor or storms brewing in the distance off the coastline. The enigma surrounding the Seneca Guns persists, and whatever the cause, the mysterious booms will continue to startle and intrigue North Carolina residents.

Read more » click here

Accommodation/Occupancy Tax Compliance

Editor’s note –

Accommodation/Occupancy Tax Compliance should go to the top of the queue because it provides an additional revenue stream. The software will allow the town to identify properties currently being used for short-term rentals. The more properties that properly comply, the more accommodations tax revenue the town will receive.

City enters into contract to monitor short-term rentals

The City of Southport hopes to have found a short-term answer that will lead to a long-term solution for its short-term vacation rental issues. The board of aldermen has authorized a one-year contract with the software company Granicus for three modules to help the city identify short-term vacation rentals within its limits. The action came by a 4-2 vote Friday at Indian Trail Meeting Hall. The cost is $9,840. “We think the best path moving forward, as the board sees fit, is to contract with Granicus for one year to see how much it benefits us,” said Assistant City Manager/City Clerk Dorothy Dutton. “It’s going to be the best source, in our mind, to capture all the existing short-term vacation rentals and monitor them for a year.”

No updated list

The city has struggled in the past to enforce its short-term vacation rental ordinance. Things became complicated when the state made annual registration requirements for short-term vacation home permits illegal. As a result, Southport removed the registration requirement from its books. The city does not have an updated annual registration list to refer to in order to identify properties being used for short-term rentals. Monitoring social media, direct observation and relying on complaints from neighbors were possible ways to try to tackle the problem, but the city may have found a better option with the use of software. Southport had about 180 short-term rentals in July 2023, said Dutton, and it derives about $250,000 in annual revenue from its occupancy tax. “I’m looking forward to the enforcement piece of this with the software because whenever you’re just relying on complaint-based (reporting), you have inconsistent enforcement,” said Alderman Karen Mosteller.

Kelley: educate owners

Aldermen Rebecca Kelley and Marc Spencer voted against the measure. Kelley said the city receives lump-sum occupancy tax payments from online booking companies Vrbo and Airbnb, but the companies don’t identify the property owners. “Is it also possible that by identifying those that are in violation right now, we could potentially lose up to $150,000 in our current revenue because as it comes in (from) Vrbo and Airbnb, those are not flagged to us as to who they are?” she asked. “So, we could potentially spend $10,000 to lose $100,000 here, guys.” Kelley liked the idea of educating current short-term rental owners and realtors about the city’s regulations. “By sharing with them what our goals are for Southport, we could potentially do this without spending the $10,000,” she said. “Now will some still sneak through? Sure. There’s no way to catch all of them by doing that, but we have the potential to not spend that much money and still catch a lot of people that are doing this and be able to move through it a different way. Rather than spending money to lose money, let’s see if we can do it by working with the people who are doing it correctly first.”

Carroll responds

Alderman Robert Carroll wasn’t convinced by that approach, saying, “My perspective on that is illegal is illegal, and I don’t care how much money we’re getting from those illegals.” He did agree that education on the matter is needed. Some people, he said, misunderstood when the city did away with the registration requirement, thinking that allowed short-term vacation rentals. “I go into situations where people are saying, ‘Oh no, short-term (rentals), you can do them again,’” Carroll said. “All we did was remove the requirement to register and pay. That’s all we did. We did not say you can go do them again. “We need to educate people that that’s the case.” Moreover, Carroll said relying on realtors to spread the word about the city’s occupancy statute “is way far-fetched. If that realtor wants to be a professional and learn these things and talk from an educated perspective, that’s their business.” After the vote was taken, Spencer said, “I think that the Airbnb law is an illegal taking of property rights and we have created a line in the sand that we are now having to enforce. I don’t necessarily like Airbnb.” “I suspect that we’ve got people that are not going through Airbnb or whatever, doing it word of mouth, whatever,” Alderman Frank Lai said. “So, we don’t know who they are. We’re losing a lot of money that way.” Carroll sounded hopeful that once people are properly informed, “We will ultimately see herd compliance. We will start to see people do what they’re supposed to do.”

Read more » click here

Previously reported – November 2023

How this Brunswick beach town is cracking down on short-term rental properties

Officials in one Brunswick County beach town are looking to keep a closer eye on short-term rental properties. After discovering many short-term rentals in Sunset Beach were underreporting or not reporting proper accommodations tax to the town, town officials have signed a $45,000 yearlong contract with GovOS to help better monitor such properties in the town. GovOS is a software platform that works with state and local governments to streamline various processes involving property, licensing and taxing. GovOS promised its short-term rental software would help increase short-term compliance in the town. According to Sunset Beach staff, research on this subject in the town began over two years ago. GovOS estimated the town has 637 short-term rental properties. Of those, the company estimated some 200 are fully in compliance with the town’s accommodation tax ordinance. Accommodations tax is a tax on short-term rental properties – properties that are rented through platforms such as AirBnB or VRBO. In Sunset Beach, accommodations taxes are levied at a rate of 6% of the gross rental income, which includes a 3% tourism-related expenditure tax, a 2% beach nourishment and protection tax, and a 1% county tourism and travel tax. According to Sunset Beach, the property owner or agent are required to pay the full 6% tax to the town with a tax report form monthly based on income from the previous month. Even if no rental receipts are applicable for that month, property owners or agents must file reports month. The software will allow the town to identify properties currently being used for short-term rentals – a feat town staff has struggled with in the wake of the explosion of short-term rental platforms such as AirBnB and VRBO. Once the properties are identified, the software will report the short-term rental properties to the town along with a variety of information on the properties and their tax reporting history. The more properties that properly comply, the more accommodations tax revenue the town will receive. According to the town’s budget for the 2023-24 fiscal year, the town anticipates collecting some $775,000 in accommodations taxes, a figure that could be nearly doubled if this software is successful. The Sunset Beach Town Council heard a presentation from GovOS in September before awarding the contract in October, at the request of town staff.

Read more » click here

This and That –

A New York Professor Wages Epic Battle Against Rats Attacking His Car

A New York Professor Wages Epic Battle Against Rats Attacking His Car

From hot sauce to hiding, desperate auto owners are trying everything to keep critters from chewing expensive wiring. ‘They will find you.’ Tom Marion, a theater professor at the City University of New York, is a survivor of roughly four rodent invasions of his car, which he parks in a city that is home to an estimated two million rats. It can feel like he’s tried as many tricks to defend his ride. The 62-year-old Manhattanite has wrapped his ignition wires in minty tape, doused garlic-scented potion on his engine, and he purposely parks in a different spot each night, trying to stay a whisker ahead of the enemy. It is as if his car is made out of cheese. “They will find you,” he says, of rats. “And they all know each other and they talk to each other.” Rodents have long ravaged automobiles, and anecdotal reports of critter-on-car B & Es rose in the pandemic, which reduced driving, a pattern that persisted. But skyrocketing now is the wild world of remedies being touted to confounded drivers, especially in cold weather when your stationary sedan can become a flop house for vagrant varmints. “Help. I have rats in my car and they are destroying everything,” said a December Reddit post, one of many like it, that drew more than 150 replies, including tips to stick bars of Irish Spring soap in the cabin, center console and trunk; “pee next to the car”; spray ammonia near the wheels; place dryer sheets under the hood and seats, or take the nuclear option: “In a few weeks your best option will likely be to set the car on fire and claim insurance,” said one suggestion. Arizona photographic artist Steve Love suspects a chipmunk snacked through about $700 of wiring in his dad’s Ford Explorer in November. Before that, a rabbit, he suspects, nearly chomped through battery cables and some blinker wiring on the same car. Love, 59, investigated purported deterrents, including a motion-sensor strobe light, but found a simpler fix. He props the vehicle hood open every night and secures it with a bungee cord to keep the wind from closing it. The idea? Deprive critters a getaway. “That way the rodent won’t feel safe in the engine compartment,” he says. The insurance industry is estimated to have paid out in more than 91,700 car-damage claims caused by rodents, squirrels, and rabbits nationally between July 1, 2022 and June 30, 2023, according to a recent analysis by State Farm. After a recent relaxing night on a Hawaii beach, Davarus Shores jumped into his 2003 gold Infiniti to return home to Honolulu—only to have the car die within minutes. Shores, who is 31 and works in the medical profession, got it towed roughly 40 miles, and mechanics handed him a $2,000 bill and a dead rat. The rodent had entered his engine and nibbled through wiring. “Poor little rat was just trying to find somewhere to chill that night,” Shores figures. To prevent incursions, car owners also slather on hot sauce so thick it drips from car wires, or wrap aluminum foil around the bottom of vehicles, under the theory it’s too slippery for rats to scale. One can buy shields and pastes that promise to make rodents turn tail and run or invest in ultrasonic pest alarms. An online car forum mentions witchcraft: “Burn rodent bones and chant Druid expulsion alms.” Will any of it work? Well, in the classic “Tom and Jerry” cartoons, Jerry the mouse usually outwitted Tom. If rats take a liking to your car, you are Tom. Spraying engines with peppermint might deter some rodents, at least temporarily. Or it might not faze them, according to Jason Munshi-South, an evolutionary biologist and professor of biology at Fordham University. Garlic oil? White Pepper? Pine-Sol? Same thing, he says. The word rodent evolved from the Latin rodere, to gnaw. “And so, they’re constantly gnawing on things, and that’s the reason they gnaw car wires,” the professor explains. In some cases, the idea that certain smells or flavors are turnoffs stems from lab tests. Given a choice, rats in captivity might avoid scented objects, says Munshi-South, but that doesn’t necessarily mean rodents in the real world will do so. Love, the Arizona artist, suspects there is some truth to the unproven but popular theory that rodents nosh on cars more as automakers switch to soy-based products to insulate wires. In legal cases, automakers have argued rodent behavior is essentially an act of God. AAA has suggested rodents might find modern vehicles appealing because of all the wiring from sensors, computers and increased technology. In New York, Marion’s first rat attack came in late 2022, when he was parking his 2015 Toyota Prius C in an open-air lot in his East Harlem neighborhood. After rats chewed through wires, the car had to be towed to a garage. Marion’s insurance footed the roughly $1,000 bill. He chalked it up to bad luck, but when it happened again soon after, he started dousing the car nightly with garlic-scented rodent repellent and “really smelly” peppermint oil. After each drive, he covered his engine with stainless steel wool, yet another rumored rodent barrier. A few weeks later, his car died again, and Marion discovered a rat, unharmed and squeaking angrily, under the hood. He had to chase it off. Next, Marion ditched the parking lot for open spots on the street, sometimes as far as a mile away. He still diligently applied rodent repellents nightly. But two weeks later, his car died as he crossed a bridge into Queens. It cost his insurance company another $1,200. In a remove-the-cheese strategy, he sold his Prius and bought a hybrid Ford Escape. Coincidence or not, he says he hasn’t had an incident since. But he can’t relax. He avoids parking near trash cans and never parks in consecutive spots. A rat might case his car, plotting for a break-in, but “by the time they come back, I’m gone,” he says. “I’m never in the same place. I am all around.”

Read more » click here

Factoid That May Interest Only Me –

Island Homes Sold – 2023 * Lou’s Views (lousviews.com)

A complete list of homes sold in 2023

Island Land Sold – 2023 * Lou’s Views (lousviews.com)

A complete list of land sold in 2023

Island Properties Sold – Comparison * Lou’s Views (lousviews.com)

A comparison of Holden Beach properties sold through the last three (3) years

Hot Button Issues –

Subjects that are important to people and about which they have strong opinions

Climate

For more information » click here

.

There’s something happening here

What it is ain’t exactly clear

It’s official: 2023 was Earth’s warmest year in a century and a half, with temperatures breaking records month after month.

The numbers are in, and scientists can now confirm what month after month of extraordinary heat worldwide began signaling long ago. Last year was Earth’s warmest by far in a century and a half. Global temperatures started blowing past records midyear and didn’t stop. First, June was the planet’s warmest June on record. Then, July was the warmest July. And so on, all the way through December. Averaged across last year, temperatures worldwide were 1.48 degrees Celsius, or 2.66 Fahrenheit, higher than they were in the second half of the 19th century, the European Union climate monitor announced on Tuesday. That is warmer by a sizable margin than 2016, the previous hottest year. To climate scientists, it comes as no surprise that unabated emissions of greenhouse gases caused global warming to reach new highs. What researchers are still trying to understand is whether 2023 foretells many more years in which heat records are not merely broken but smashed. In other words, they are asking whether the numbers are a sign that the planet’s warming is accelerating. “The extremes we have observed over the last few months provide a dramatic testimony of how far we now are from the climate in which our civilization developed,” Carlo Buontempo, the director of the E.U.’s Copernicus Climate Change Service, said in a statement. Every tenth of a degree of global warming represents extra thermodynamic fuel that intensifies heat waves and storms, adds to rising seas and hastens the melting of glaciers and ice sheets. Those effects were on display last year. Hot weather baked Iran and China, Greece and Spain, Texas and the American South. Canada had its most destructive wildfire season on record by far, with more than 45 million acres burned. Less sea ice formed around the coasts of Antarctica, in both summer and winter, than ever measured. NASA, the National Oceanic and Atmospheric Administration and the research group Berkeley Earth are scheduled to release their own estimates of 2023 temperatures later this week. Each organization’s data sources, and analytical methods are somewhat different, though their results rarely diverge by much. Under the 2015 Paris Agreement, nations agreed to limit long-term global warming to 2 degrees Celsius, and, if possible, 1.5 degrees. At present rates of greenhouse gas emissions, it will only be a few years before the 1.5-degree goal is a lost cause, researchers say. Carbon dioxide and other greenhouse gases are the main driver of global warming. But last year several other natural and human-linked factors also helped boost temperatures. The 2022 eruption of an underwater volcano off the Pacific island nation of Tonga spewed vast amounts of water vapor into the atmosphere, helping trap more heat near Earth’s surface. Recent limits on sulfur pollution from ships brought down levels of aerosols, or tiny airborne particles that reflect solar radiation and help cool the planet. Another factor was El Niño, the recurrent shift in tropical Pacific weather patterns that began last year and is often linked with record-setting heat worldwide. And that contains a warning of potentially worse to come this year. The reason: In recent decades, very warm years have typically been ones that started in an El Niño state. But last year, the El Niño didn’t start until midyear — which suggests that El Niño wasn’t the main driver of the abnormal warmth at that point, said Emily J. Becker, a climate scientist at the University of Miami. It is also a strong sign that this year could be hotter than last. “It’s very, very likely to be top three, if not the record,” Dr. Becker said, referring to 2024. Scientists caution that a single year, even one as exceptional as 2023, can tell us only so much about how the planet’s long-term warming might be changing. But other signs suggest the world is heating up more quickly than before. About 90 percent of the energy trapped by greenhouse gases accumulates in the oceans, and scientists have found that the oceans’ uptake of heat has accelerated significantly since the 1990s. “If you look at that curve, it’s clearly not linear,” said Sarah Purkey, an oceanographer with the Scripps Institution of Oceanography at the University of California, San Diego. A group of researchers in France recently found that the Earth’s total heating — across oceans, land, air and ice — had been speeding up for even longer, since 1960. This broadly matches up with increases in carbon emissions and reductions in aerosols over the past few decades. But scientists will need to continue studying the data to understand whether other factors might be at work, too, said one of the researchers, Karina von Schuckmann, an oceanographer at Mercator Ocean International in Toulouse, France. “Something unusual is happening that we don’t understand,” Dr. von Schuckmann said.

Read more » click here

Scientists knew 2023’s heat would be historic — but not by this much

The year 2023 was the hottest in recorded human history, Europe’s top climate agency announced Tuesday, with blistering surface temperatures and torrid ocean conditions pushing the planet dangerously close to a long-feared warming threshold. According to new data from the Copernicus Climate Change Service, Earth’s average temperature last year was 1.48 degrees Celsius (2.66 degrees Fahrenheit) hotter than the preindustrial average, before humans began to warm the planet through fossil fuel burning and other polluting activities. Last year shattered the previous global temperature record by almost two-tenths of a degree — the largest jump scientists have ever observed. This year is predicted to be even hotter. By the end of January or February, the agency warned, the planet’s 12-month average temperature is likely to exceed 1.5 degrees Celsius (2.7 degrees Fahrenheit) above the preindustrial level — blasting past the world’s most ambitious climate goal. The announcement of a new temperature record comes as little surprise to scientists who have witnessed the past 12 months of raging wildfires, deadly ocean heat waves, cataclysmic flooding and a worrisome Antarctic thaw. A scorching summer and “gobsmacking” autumn temperature anomalies had all but guaranteed that 2023 would be a year for the history books. But the amount by which the previous record was broken shocked even climate experts. “I don’t think anybody was expecting anomalies as large as we have seen,” Copernicus director Carlo Buontempo said. “It was on the edge of what was plausible.” The staggering new statistics underscore how human-caused climate change has allowed regular planetary fluctuations to push temperatures into uncharted territory. Each of the past eight years was already among the eight warmest ever observed. Then, a complex and still somewhat mysterious host of climatic influences combined with human activities to push 2023 even hotter — ushering in an age of “global boiling,” in the words of United Nations Secretary General António Guterres. Unless nations transform their economies and rapidly transition away from polluting fuels, experts warn, this level of warming will unravel ecological webs and cause human-built systems to collapse.

A year that ‘doesn’t have an equivalent’

When ominous warmth first appeared in Earth’s oceans last spring, scientists said it was a likely sign that record global heat was imminent — but not until 2024. But as the planet transitioned into an El Niño climate pattern — characterized by warm Pacific Ocean waters — temperatures took a steeper jump. July and August were the two warmest months in the 173-year record Copernicus examined. As Antarctic sea ice dwindled and the planet’s hottest places flirted with conditions too extreme for people to survive, scientists speculated that 2023 would not only be the warmest on record — it might well exceed anything seen in the last 100,000 years. Analyses of fossils, ice cores and ocean sediments suggest that global temperatures haven’t been this high since before the last ice age, when Homo sapiens had just begun to migrate out of Africa and hippos roamed in what is now Germany. Autumn brought even greater departures from the norm. Temperatures in September were almost a full degree Celsius hotter than the average over the past 30 years, making it the most unusually warm month in Copernicus’s data set. And two days in November were, for the first time ever, more than 2 degrees Celsius (3.6 degrees Fahrenheit) hotter than the preindustrial average for those dates. “What we have seen in 2023 doesn’t have an equivalent,” Buontempo said. The record-setting conditions in 2023 were driven in part by unprecedented warmth in the oceans’ surface waters, Copernicus said. The agency measured marine heat waves from the Indian Ocean to the Gulf of Mexico. Parts of the Atlantic Ocean experienced temperatures 4 to 5 degrees Celsius (7.2 to 9 degrees Fahrenheit) above average — a level that the National Oceanic and Atmospheric Administration classifies as “beyond extreme.” While researchers have not yet determined the impacts on sea life, similar heat waves have caused massive harms to microorganisms at the base of the food web, bleached corals and fueled toxic algae blooms, she added. Though the oceans cover about two-thirds of Earth’s surface, scientists estimate they have absorbed about 90 percent of the extra warming from humans’ burning of fossil fuels and the greenhouse effect those emissions have in the atmosphere. “The ocean is our sentinel,” said Karina von Schuckmann, an oceanographer at the nonprofit Mercator Ocean International. The dramatic warming in the ocean is a clear signal of “how much the Earth is out of energy balance,” she added — with heat continuing to build faster than it can be released from the planet.

What drove the record warmth

Scientists are still disentangling the factors that made 2023 so unusual. The largest and most obvious is El Niño, the infamous global climate pattern that emerges a few times a decade and is known to boost average planetary temperatures by a few tenths of a degree Celsius, or as much as half a degree Fahrenheit. El Niño’s signature is a zone of warmer-than-normal waters in the central and eastern equatorial Pacific Ocean, which release vast amounts of heat and water vapor and trigger extreme weather patterns around the world. But El Niño alone cannot explain the extraordinary heat of the past 12 months, according to Copernicus. Because it wasn’t just the Pacific that exhibited dramatic warmth in 2023. Scientists also believe the Atlantic may have warmed as a result of weakened westerly winds, which tend to churn up waters and send surface warmth into deeper ocean layers. It could also have been the product of below-normal Saharan dust in the air; the particles normally act to block some sunlight from reaching the ocean surface. Around the world, in fact, there has been a decline in sun-blocking particles known as aerosols, in large part because of efforts to reduce air pollution. In recent years, shipping freighters have taken measures to reduce their emissions. Scientists have speculated the decline in aerosols may have allowed more sun to reach the oceans. And then there is the potential impact of a massive underwater volcanic eruption. When Hunga Tonga-Hunga Ha’apai blasted a plume 36 miles high in January 2022, scientists warned it released so much water vapor into the atmosphere, it could have a lingering effect for months, if not years, to come. NASA satellite data showed the volcano sent an unprecedented amount of water into the stratosphere — equal to 10 percent of the amount of water that was already contained in the second layer of Earth’s atmosphere. In the stratosphere, water vapor — like human-caused emissions of carbon dioxide — acts as a greenhouse gas, trapping heat like a blanket around the Earth. But it won’t be clear how much of a role each of those factors played until scientists can test each of those hypotheses. What is clear, scientists stress, is that the year’s extremes were only possible because they unfolded against the backdrop of human-caused climate change. The concentration of carbon dioxide in the atmosphere hit a record high of 419 parts per million in 2023, Copernicus said. And despite global pledges to cut down on methane — which traps 86 times as much heat as carbon dioxide over a short time scales — levels of that gas also reached new peaks. Only by reaching “net zero” — the point at which people stop adding additional greenhouse to the atmosphere — can humanity reverse Earth’s long-term warming trend, said Paulo Ceppi, a climate scientist at Imperial College London. “That is what the physical science tells us that we need to do,” Ceppi said.

What comes next

Almost half of all days in 2023 were 1.5 degrees Celsius warmer than the preindustrial average for that date, Copernicus said — giving the world a dangerous taste of a climate it had pledged to avoid. At the Paris climate conference in 2015, nations agreed to a stretch goal of “pursuing efforts to limit the temperature increase to 1.5C above preindustrial levels.” Three years later, a special report from the Intergovernmental Panel on Climate Change found that staying within this ambitious threshold could avoid many of the most disastrous consequences of warming — but it would require the world to almost halve greenhouse gas emissions in just over a decade. But emissions have continued to rise, and now the world appears poised on the brink of surpassing the Paris target. At least one climate science organization believes the barrier has already been crossed. Berkeley Earth said in December that 2023 is virtually certain to eclipse it, though its estimates of 19th century temperatures are slightly lower than those other climate scientists use. This doesn’t necessarily mean the world has officially surpassed the limit set in the Paris climate agreement in 2015. That benchmark will only be reached when temperatures remain 1.5 degrees Celsius above average over a period of at least 20 years. But scientists are already speculating that the planet could set another average temperature record in 2024. Some also say the latest spike in global temperatures is a sign the rate of climate change has accelerated. Whether or not 2023 surpasses the 1.5 degree limit, the year “has given us a glimpse of what 1.5 may look like,” Buontempo said. He hoped that the latest record allows that reality to set in — and spurs action. “As a society, we have to be better at using this knowledge,” Buontempo added, “because the future will not be like our past.”

Read more » click here

Flood Insurance Program

For more information » click here

National Flood Insurance Program: Reauthorization

Congress must periodically renew the NFIP’s statutory authority to operate. On November 17, 2023, the President signed legislation passed by Congress that extends the National Flood Insurance Program’s (NFIP’s) authorization to February 2, 2024.

Congress must now reauthorize the NFIP

by no later than 11:59 pm on February 2, 2024.

More states deciding home buyers should know about flood risks

More states deciding home buyers should know about flood risks

‘It’s a recognition that flooding is only going to get worse and that they need to take action now to protect home buyers and renters,’ says one advocate

Hours into a marathon meeting earlier this month, and with little fanfare, the North Carolina Real Estate Commission gave its blessing to a proposal that could have profound impacts in a state where thousands of homes face threats from rising seas, unprecedented rainfall and overflowing rivers. Soon, anyone who sells a home in the state will be required to disclose to prospective buyers far more about a property’s flood risks — and flood history. Rather than merely noting whether a home is in a federally designated flood zone, they will have to share whether a property has flood insurance, whether any past flood-related claims have been filed, or if the owner has ever received any federal assistance in the wake of a hurricane, tidal inundation or other flood-related disaster. With the changes, North Carolina became the fourth state this year to embrace more stringent disclosure requirements, joining South Carolina, New York and New Jersey. Advocates say the shifts, which for the most part encountered little outward opposition, represent an acknowledgment that flood risks are surging throughout the country and that more transparency about those risks is a common-sense measure that could mean more homes have flood insurance and fewer buyers face catastrophic surprises. “It’s a recognition that flooding is only going to get worse and that they need to take action now to protect home buyers and renters,” said Joel Scata, a senior attorney at the Natural Resources Defense Council, which tracks flood disclosure laws around the country. “It’s also a recognition of the importance of transparency and fairness.” The changing disclosure policies come at a time when scientists say the nation’s coastlines will experience as much sea level rise in the coming few decades as they have over the past century. They also have documented how the warming atmosphere is creating more powerful storms and more torrential and damaging rainfalls, which already are inundating communities where aging infrastructure was built for a different era and a different climate. The more stringent rules adopted this year also follow a path set by some of the country’s most flood-battered states. Louisiana, facing massive land loss from rising seas and the prospect of stronger storms, has what environmental advocates and even the Federal Emergency Management Administration agree is one of the most robust sets of disclosure laws in the nation. Likewise, in the wake of cataclysmic flooding caused by Hurricane Harvey in 2017, Texas adopted new rules that have also made the state a model for flood disclosure. But even as several additional states finalized new disclosure rules in 2023, many others still do not require sellers to divulge to buyers whether a home has previously flooded. That includes places such as Florida, which faces significant and rising risks from hurricanes, climate-fueled rain bombs and inland flooding along rivers. According to NRDC, more than one-third of states have no statutory or regulatory requirement that a seller must disclose a property’s flood risks or past flood damage to potential buyers. Others have varying degrees of requirements — a patchwork that means where people live can greatly influence how much they actually know about the flood risks of a home they buy or rent. “There are still too many states who keep home buyers in the dark,” Scata said. “That needs to change. Flooding is only going to become more severe due to climate change. And people have a right to know whether their dream home could become a nightmare due to flooding.” Earlier this year, FEMA proposed federal legislation that would require states to mandate certain minimum flood risk reporting requirements as a condition for ongoing participation in the National Flood Insurance Program. The agency said having a nationwide requirement would “increase clarity and provide uniformity” in many real estate transactions, but it has not yet become a reality. That lack of action on Capitol Hill has not stopped individual states from moving forward. In June, the South Carolina Real Estate Commission added new questions to the state’s residential disclosure that go into far more detail than before, including whether a homeowner has filed public or private flood insurance claims or made flood-related repairs that weren’t submitted to an insurer. “It’s definitely a step in the right direction,” said Nick Kremydas, chief executive of South Carolina Realtors, which publicly supported the enhanced disclosure requirements. Still, he said he hopes Congress will eventually allow buyers to access FEMA’s database of flood claims for individual properties. “That’s the best-case scenario.” Over the summer, New Jersey’s legislature overhauled what NRDC had labeled the state’s “dismal” disclosure requirements, instead putting in place new rules that require sellers to document a wide range of flood-related information. In addition, it requires that purchasers in coastal areas be warned about the potential impacts of sea level rise. “The idea is that the more people understand about the hazards, the more they can incorporate that into their decision-making, and the more they can have ownership of those decisions,” said Peter Kasabach, executive director of New Jersey Future, a nonprofit that advocates smarter growth and resilience policies. In September, New York Gov. Kathy Hochul (D) signed similar legislation, calling it a “monumental step” toward protecting residents from the increasing impacts of climate change. In addition to mandating more detailed flood information, it eliminated a previous option that allowed sellers to provide a $500 credit at closing in exchange for waiving the disclosure requirement. The legislation followed a similar measure from late 2022, requiring flood disclosures for renters. “This is a person’s home, and they should be warned,” said New York State Assembly member Robert Carroll (D), a prime sponsor of the disclosure bills. “This is really about knowledge and proper warning.” In large swaths of the country, there is little doubt that more properties are likely to face flooding risks over time. A report last year by the National Oceanic and Atmospheric Administration, NASA and other federal agencies projected that U.S. coastlines will face an additional foot of rising seas by 2050. NOAA has detailed how specific places are likely to see a sharp rise in high-tide, or nuisance, flooding, and that coastal flood warnings “will become much more commonplace” in coming decades. Likewise, scientists have documented an abnormal and dramatic surge in sea levels along the U.S. gulf and southeastern coastlines since about 2010, and other researchers have warned that the nation’s real estate market has yet to fully account for the expanding threats posed by rising seas, stronger storms and torrential downpours. In a study last year commissioned by NRDC, the independent actuarial consulting firm Milliman found that in New Jersey, New York and North Carolina, 28,826 homes sold in 2021 — 6.6 percent of total sales — were estimated to have been previously flooded. In addition, the firm found that expected future annual losses for a home with previous flood damage are significantly higher in each state than for the average of all homes, regardless of flood damage, in that state. Because one of the best indicators of whether a house will flood is whether it has flooded before, meaningful disclosure requirements are crucial, said Brooks Rainey Pearson, legislative counsel for the North Carolina branch of the Southern Environmental Law Center, which last year petitioned the state’s real estate commission on behalf of multiple environmental and community groups to make the disclosure changes. “People can take steps to protect themselves when you give them the information they need,” she said. “It matters, because with climate change we are seeing more frequent flooding events, including more intense storms and more flooding of houses. It’s a huge investment for a family to make to buy a house. People deserve to know whether the house they are purchasing has flooded or could flood.” Pearson says she hopes the changes coming to North Carolina and other states will help illuminate otherwise unknown risks and ultimately help reduce the number of homeowners who are displaced and devastated financially after storms such as Hurricane Florence, which battered her state in 2018. “What it comes down to,” she said, “is giving the buyer the information they need to make smart decisions.”

Read more » click here

GenX

For more information » click here

Homeowners Insurance

For more information » click here

Insurance firms seek 42% rate hike for NC homes with 99% increase at coast

Insurance companies are seeking a more than 40 percent average rate increase for coverage of homes in North Carolina with much higher rates sought at the coast, according to a Friday news release from the North Carolina Department of Insurance. The North Carolina Rate Bureau, which represents companies that write insurance policies in the state, is requesting a 42.2 percent rate increase for homeowners’ insurance, the news release said. The highest rate increases — at 99.4 percent — would essentially double costs for homeowners in beach areas in Brunswick, Carteret, New Hanover, Onslow, and Pender counties, the news release indicated. Insurance companies are seeking a 39.8 percent hike for homes in Durham and Wake counties, including Raleigh and Durham. Under the proposal from the insurance companies, the rate hike would go into action on Aug. 1. An earlier rate increase request for homeowners insurance from the bureau in November 2020 was for an average hike of 24.5 percent in North Carolina. However, after a settlement with the North Carolina Department of Insurance, the overall rate increase ended up being 7.9 percent, the news release said. A public comment period is required by law to give the public time to address the proposed 42.2 percent rate increase. All public comments will be shared with the North Carolina Rate Bureau. If North Carolina Department of Insurance officials do not agree with the requested rates, the rates will either be denied or negotiated with the North Carolina Rate Bureau. If a settlement cannot be reached within 50 days, Department of Insurance Commissioner Mike Causey will call for a hearing.

Below are the ways to provide public comments:

- A public comment forum will be held to listen to public input on the North Carolina Rate Bureau’s rate increase request at the North Carolina Department of Insurance’s Jim Long Hearing Room on Jan. 22 from 10 a.m. to 4:30 p.m. The Jim Long Hearing Room is in the Albemarle Building, 325 N. Salisbury St., Raleigh, N.C. 27603.

- A virtual public comment forum will be held simultaneously with the in-person forum on Jan. 22 from 10 a.m. to 4:30 p.m. The link to this virtual forum will be: https://ncgov.webex.com/ncgov/j.php?MTID=mb3fe10c8f69bbedd2aaece485915db7e

- Emailed public comments should be sent by Feb. 2 to an email at [email protected].

- Written public comments must be received by Kimberly W. Pearce, Paralegal III, by Feb. 2 and addressed to 1201 Mail Service Center, Raleigh, N.C. 27699-1201.

A more detailed breakdown of the list by zip codes for some areas is available from the North Carolina Department of Insurance by clicking here (pdf document).

Territory 140 / Eastern Coastal areas of Brunswick County zip code 28462

NCRB proposed increase 71.4%

Read more » click here

Previously reported – November 2020

Insurance companies request rate increase for homeowners

The North Carolina Rate Bureau (NCRB) has requested a 24.5 percent statewide average increase in homeowners’ insurance rates to take effect August 2021, according to a news release issued Nov. 10 by state insurance commissioner Mike Causey. The NCRB is not part of the N.C. Department of Insurance but represents companies that write insurance policies in the state. The department can either agree with the rates as filed or negotiate a settlement with the NCRB on a lower rate. If a settlement cannot be reached within 50 days, Causey will call for a hearing. Two years ago, in December 2018, the NCRB requested a statewide average increase of 17.4 percent. Causey negotiated a rate 13.4 percentage points lower and settled with a statewide average rate increase of 4 percent. One of the drivers behind this requested increase is that North Carolina has experienced increased wind and hail losses stemming from damaging storms. A public comment period is required by law to give the public time to address the NCRB’s proposed rate increase.

For more information » click here.

Sticker shock: NC’s insurance companies want to raise rates for coastal homeowners by 99%

Living along the coast could be about to get more expensive if the state’s insurance industry has its way. Blame increased risk from climate change and surging coastal property values

The proposed increases are eye watering. The N.C. Rate Bureau, which represents the insurance industry in the Tar Heel State, has asked state regulators to approve a massive increase in homeowner insurance rates. How big? Well, the increase would average out to about 42% statewide. But that figure, as large as it is, doesn’t encompass the hit some property owners would take, especially along the coast. Here’s a look at how badly coastal homeowners could be hit by higher insurance rates, what’s behind the industry’s logic for proposing such massive increases, and what rate hikes are consumers really likely to see.

Sticker shock

The proposal would hammer property owners in coastal areas of the Cape Fear region. The bureau has proposed an increase of 99.4% for beachfront properties in New Hanover, Brunswick and Pender counties in the Wilmington area and Carteret County, which includes Emerald Isle. Farther up the N.C. coast, beach areas along the Outer Banks would see a 45% increase. Areas on the mainland but near the Intracoastal Waterway in the Wilmington area would see proposed increases of 71.4% for those roughly from U.S. 17 oceanward and 43% for those farther inland. The increases would be determined by a property’s ZIP code. Proposed increases in the rest of the state also would be substantial, but not as much as a gut punch for coastal homeowners in Southeastern North Carolina. In coastal areas between Morehead City and the Virginia state line, most policies would jump by roughly 25%. Farther inland, Duplin and Lenoir counties would see rates go up 71%, while Triangle homeowners would see a price increase of nearly 40%. The proposed increases around Charlotte and Asheville would be 41% and 20%, respectively. The new increase comes a little over three years after the insurance industry requested an overall average increase of 24.5%. That filing resulted in a settlement between insurers and the state for an overall average rate increase of 7.9%.

Why hit the coast so hard?

Industry officials say a lot of factors are at play that’s making insuring properties at the coast more risky and less profitable. Near the top is the inherent uncertainty and increased risk brought on by climate change. The warming weather is allowing bigger and more powerful hurricanes to threaten coastal areas up and down the U.S. Gulf and East Coasts. The changing climate, which means tropical systems can hold more moisture, travel farther inland, and threaten areas farther north, is also expanding the traditional hurricane season into the early spring and early winter periods. Flooding woes also are widening beyond traditional flood-prone areas as infrastructure is overwhelmed by periods of heavy rainfall − ala Hurricanes Matthew in 2016 and Florence in 2018. Damages tied to Florence, for example, were estimated to top $22 billion in North Carolina, with much of that hitting inland areas. Jarred Chappell, chief operating officer with the rate bureau, said the increase in the number of natural disasters and the payments forked out by insurance companies in their wake is also driving up the cost of insurance that the insurance companies themselves take out to help them stay solvent during high claim events. He estimated the cost of reinsurance, the insurance for insurers, is rising at nearly 50% a year, with no one clear when the massive increases that companies have to shoulder or pass on to their customers will end. Chappell said rising costs for labor and raw materials also are making repairs more expensive, further eating into the cost for insurers. But another factor, officials say, is one that homeowners probably on one hand don’t mind seeing − the rising value of coastal property. Nearly a dozen homes in New Hanover County have sold for more than $6 million, and nearly all of those sales have occurred in the past few years, according to MLS statistics. Even more “affordable” properties have seen their values surge in the lead up and through the pandemic years. Using data from the real estate website Zillow, the online data website Stacker determined that Wrightsville Beach was the North Carolina community with the fastest-growing home prices. The site said home values in the popular New Hanover County beach town averaged nearly $1.35 million in March 2023, with prices up 8.6% over one year and 82% over five years. Among other Tar Heel communities that have seen the biggest property value increases, a big chunk were other towns clustered on or near the state’s string of barrier islands. Rebuilding or repairing more valuable property is inherently more expensive. And the rising risk for insurers comes just as more and more people are deciding to give coastal living a shot. The population of New Hanover, Brunswick and Pender counties − the Wilmington metropolitan statistical area (MSA) − is forecast to increase from 450,000 in 2020 to more than 625,000 by 2040. Other coastal areas in the South, such as Florida and South Carolina, are seeing similar population booms.

Are coastal homeowners getting picked on?

Considering other recent rate increases, a lot of residents probably feel that way. The N.C. rate bureau last summer proposed a 50.6% increase in dwelling insurance rates, which covers second homes and rental properties. While rates statewide would rise by more than half under the plan, they would increase much more near the coast. The proposed increases for extended coverage in “Territory 140,” which covers beach and coastal areas in Southeastern North Carolina, would go up more than 97% for buildings and 70% for contents. A public hearing on the proposed increases is scheduled for April 8. The federal government also is looking to “right-size” its financial liabilities in our new climate change-influenced world by significantly raising the costs of participating in FEMA’s National Flood Insurance Program by moving to a risk-based approach in determining premiums. First Street Foundation, a nonprofit research and technology group based in Brooklyn, New York, estimates the average flood insurance premium charged to the country’s most flood-prone homes would have to more than quadruple to make the flood program, which annually bleeds red ink, solvent and ensure homeowners are paying their fair share. Under congressional and other pressures, FEMA will now raise premiums by a maximum of 18% a year until policies meet the new rate recommendation on a property’s potential risk. Many coastal and inland areas in Southeastern N.C. are in areas where flood insurance is required if you have a mortgage.

What happens now?